🎢 Overarching Themes

Trend: Market in uptrend.

Narrative: AI Bubble thesis intact; another check-in week.

Market-Cap Expansion (>$3T): MSFT, NVDA, AAPL.

Drivers: AI, semis/compute, cybersecurity, software, robotics, crypto

📊 Weekly Themes

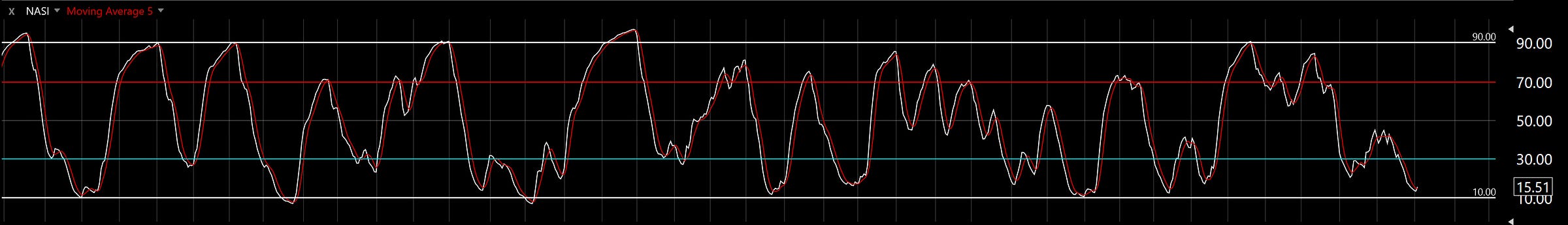

NASI. The Nasdaq McClellan Summation Index (NASI) is probing the lower end of its range and may be setting up for a turn higher.

Tactical stance: maintain caution until the curl/confirmation is evident.

Price action. Many leaders pulled back to/near breakout levels; smaller growth cohorts remain extended.

Examples: NVDA, PLTR - OKLO, SNDK.

Weak links. A subset of names is threatening breakdowns—stand aside and reassess on clearer signals.

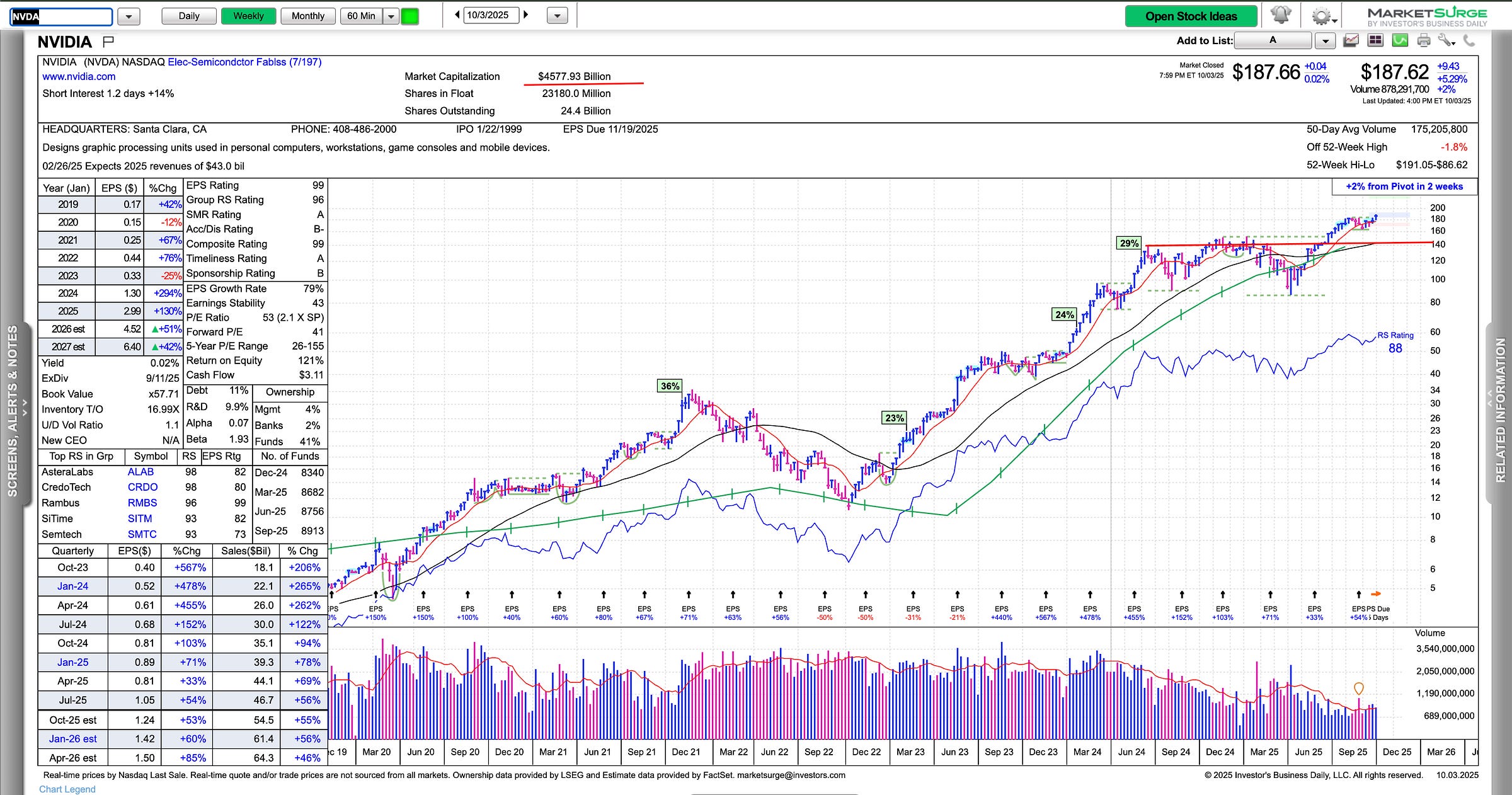

NVDA at $5T: Potential Midpoint of the AI Cycle; Re-Risk on Confirmation of $5T capture.

Thoughts:

My 30,000-foot view: we’re likely about halfway through the “AI bubble.” NVDA is my bellwether. On Friday it came within ~5% of a $5T market cap. My core thesis has been that NVDA can reach $10T, with $5T as the likely halfway point. This is a hypothesis: if I’m right, NVDA should push through $5T, and that would be the pivotal signal that we’re headed toward $10T.

Because this is still hypothesis—and given the magnitude of the run—it’s reasonable to protect capital here, reset, and then, once NVDA pushes and holds $5T, put on exposure aggressively again. I’m still bullish and I still believe the initial thesis; there are several ways to handle this area.

Importantly, the stocks that worked from $3T → $5T NVDA may not be the same ones that lead from $5T → $10T. This is a good point to reset and make fresh judgments based on what leadership actually does.

There’s real risk of both consolidation and a potential top. We don’t want to be blindly bullish—especially in smaller growth names that have moved a significant percentage in a short time, and even more so if that’s paired with significant margin.

Breadth/liquidity: The NASI finished last week at a meaningfully low level. That can create excellent risk/reward, but also liquidity landmines—sharp drops, gap-downs, and green-to-red reversals after gap-ups. I’m very bullish and excited here, but the emphasis this weekend is: recognize the hurdles and risks so we don’t get caught. Step one for a turn is present in the NASI, but let’s demand confirmation from leadership before scaling up.

Free flowing overview this week so we can focus on whats most important.

NVDA sits ~8–9% below a $5T market cap, which is my primary near-term caution flag. I remain structurally bullish, but this prospective milestone is a meaningful market event worth keeping in mind. The stock is ~30% above its recent base breakout, enough runway to justify a larger move and the weekly trend remains constructive. Net: bullish stance intact, with respect for the $5T waypoint as a tactical check.

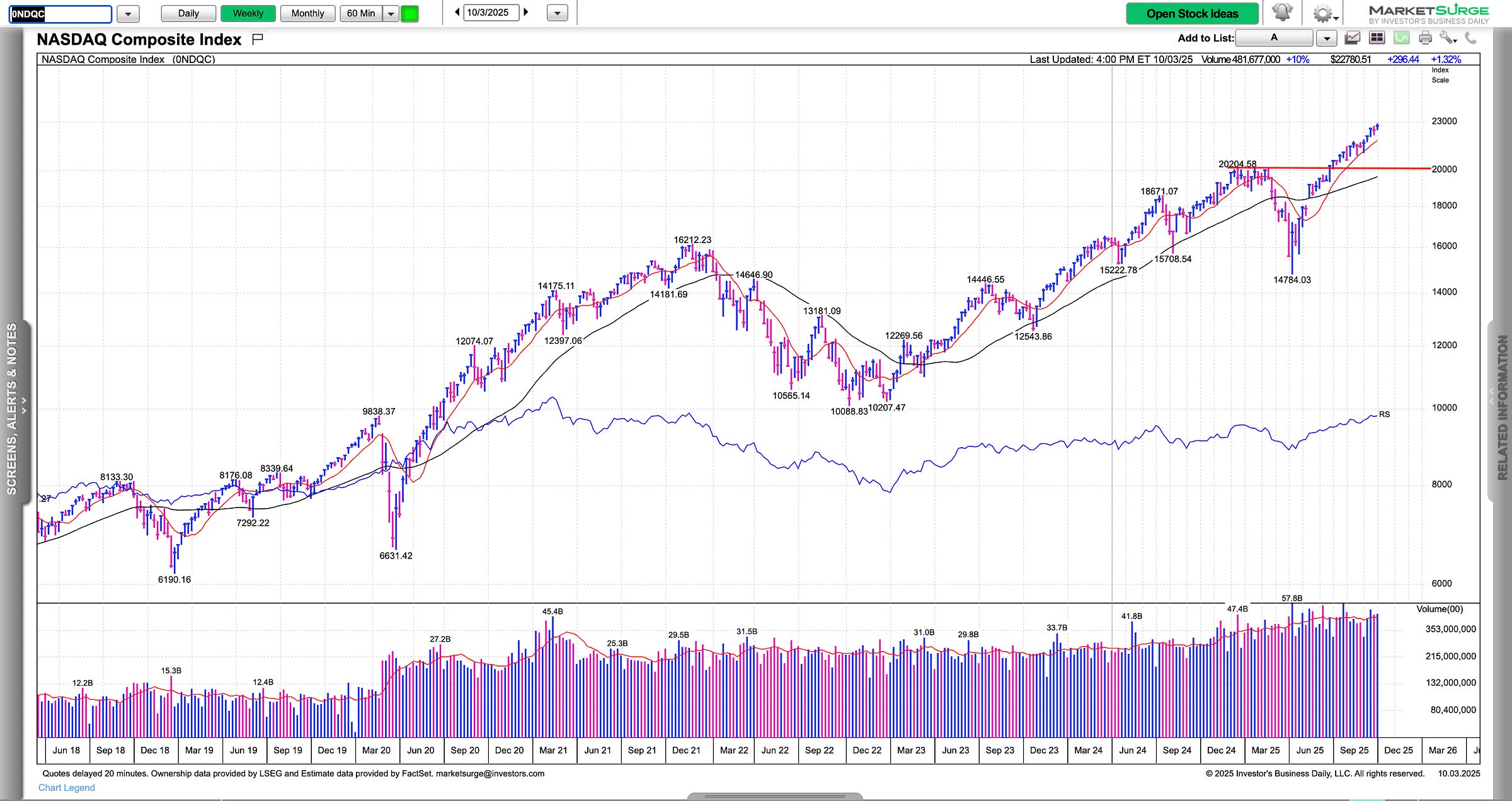

The Nasdaq Composite’s weekly structure affirms the uptrend we just experienced, and the “lockout rally” off the spring lows has unfolded broadly in line with the 1998 comparison we speculated on. With NVDA nearing a $5T market cap and the index riding above the 50-day from the lows, it’s prudent to review positioning and prepare for higher volatility than we’ve seen recently. This isn’t a top call—just disciplined risk management: reviewing the portfolio here makes sense.

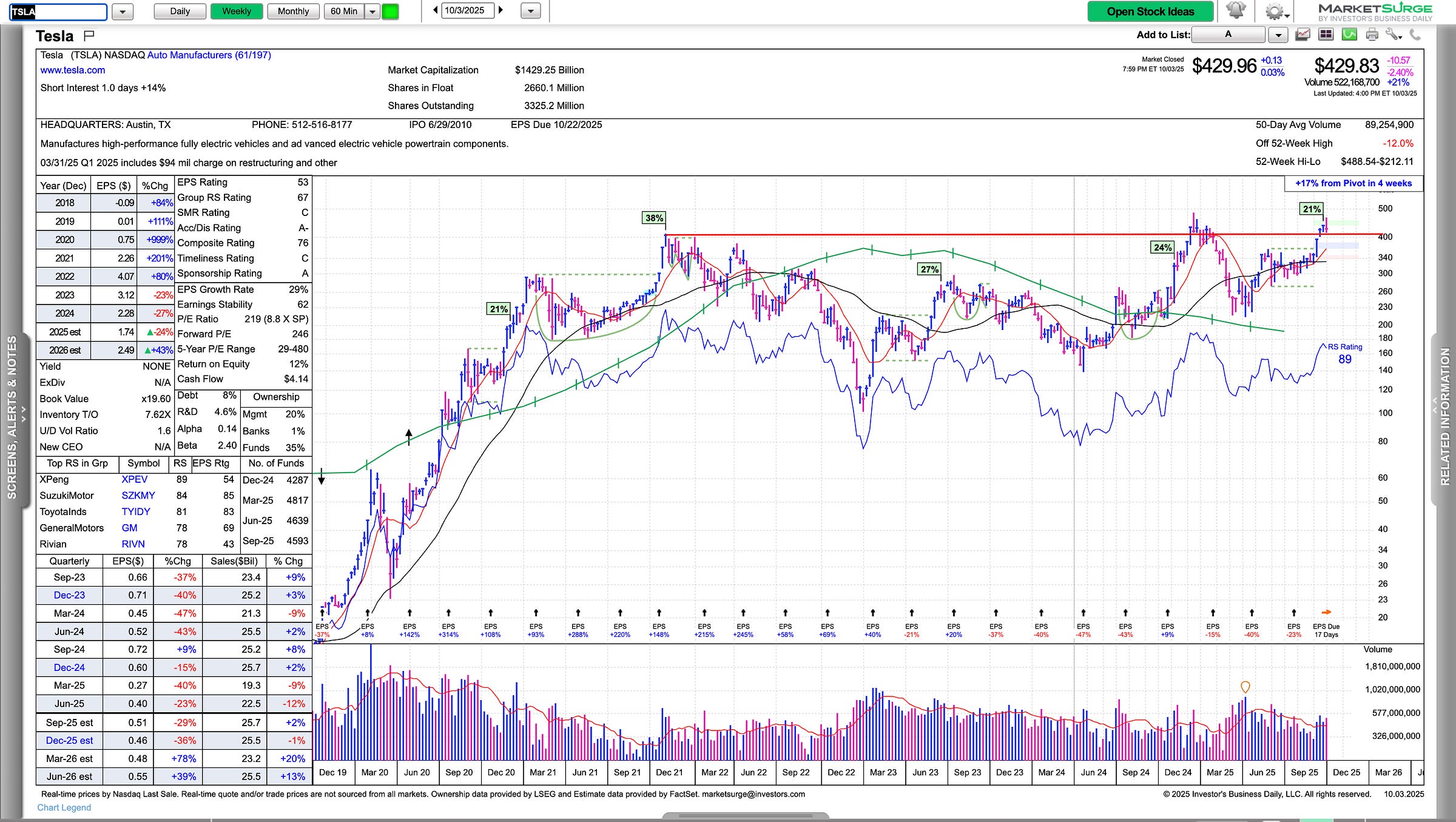

TSLA has pulled back toward the prior breakout zone near ~$420 after a swift push toward $500. On the weekly chart, this may be a handle forming; if confirmed, it’s a high-quality continuation setup. Despite the reversal, price remains above the 20-day moving average, keeping the near-term trend intact. $500 is the pivotal level, and TSLA remains my highest-conviction name.

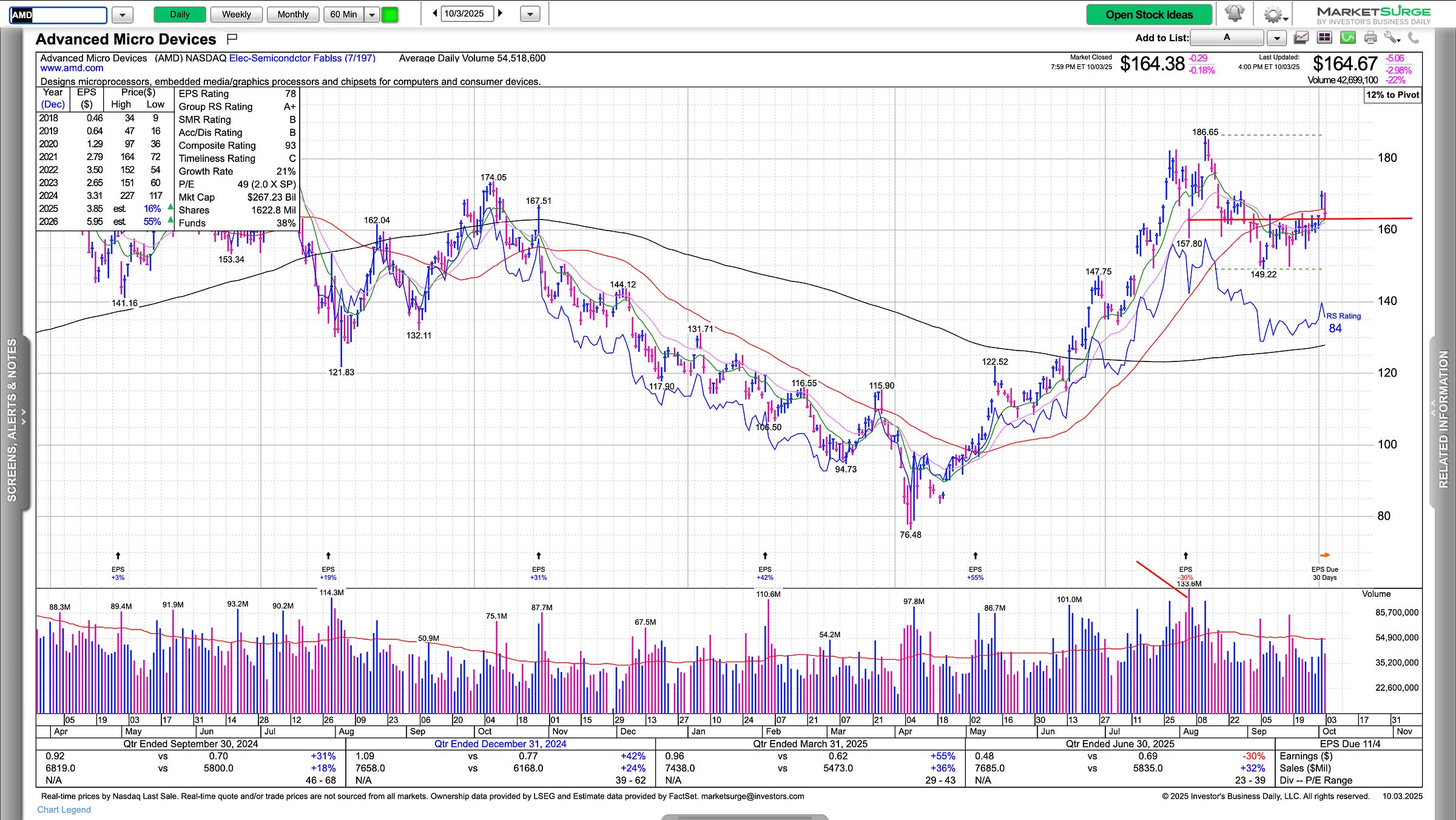

AMD briefly pushed through its pivot and then faded to retest into Friday; the pivot remains $163.12. I continue to view AMD as a likely major winner in the AI cycle, but it hasn’t delivered a decisive breakout yet. We’re at an inflection: a clean reclaim and hold above $163.12, ideally driving meaningfully through the ~$168 area, would argue for a larger leg higher. There’s notable left-side supply to work through, so follow-through matters. Failure to retake and hold those levels leaves the stock range-bound or lower near term. I could envision this band getting cleared via an earnings-day gap: speculative, but makes sense for getting the most people wrong in this name.

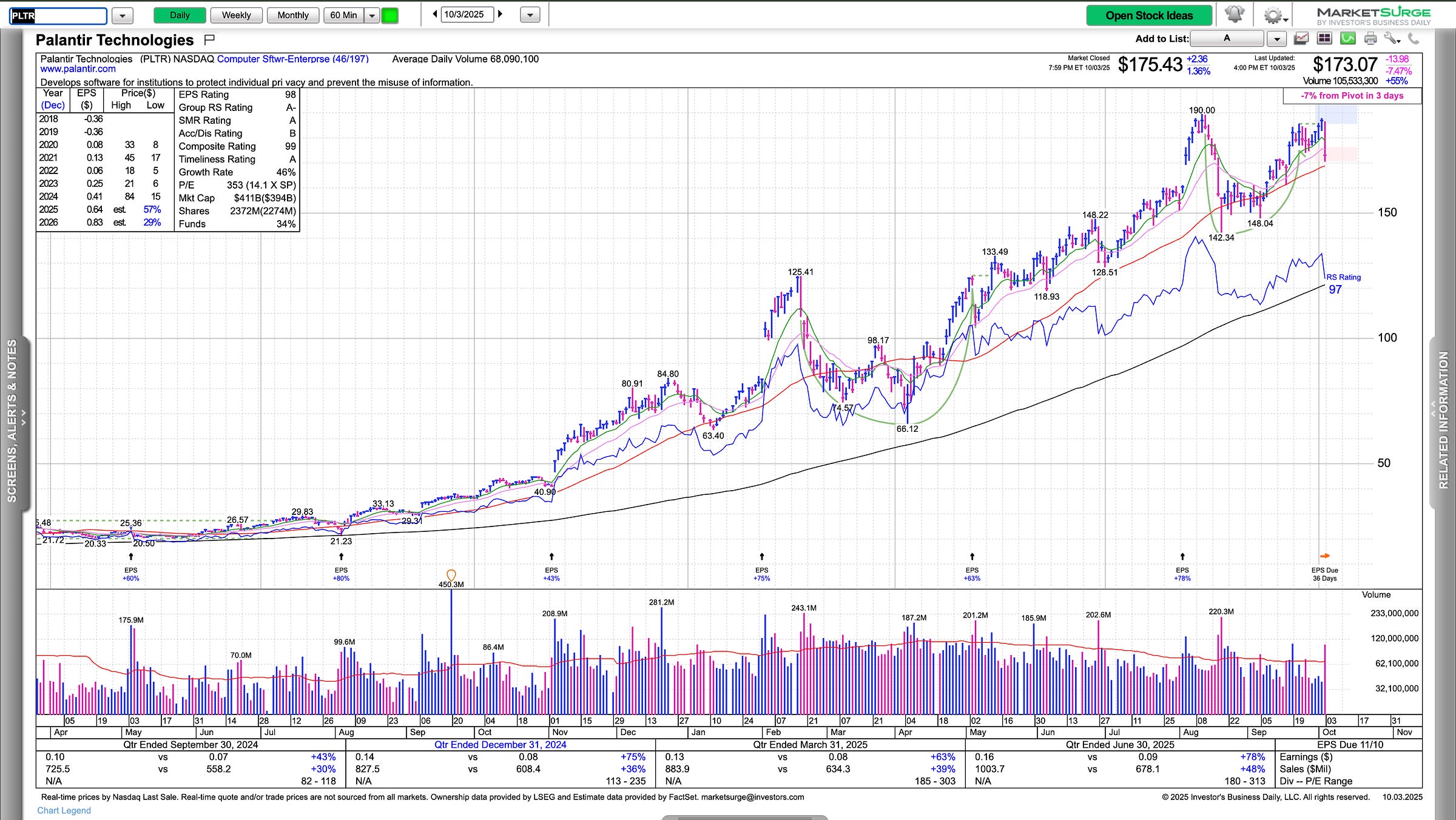

Two of the most important AI bellwethers are pressing into big round-number milestones—NVDA near $5T and PLTR near $500B—and both have shown supply on approach (PLTR’s ~8% reversal Friday underscores it). That symmetry is the source of my hesitancy this week: when leadership stalls at major thresholds, I want to stay alert and reactive, not complacent. Bias remains bullish, but I’m treating these caps as tactical checkpoints before adding risk.

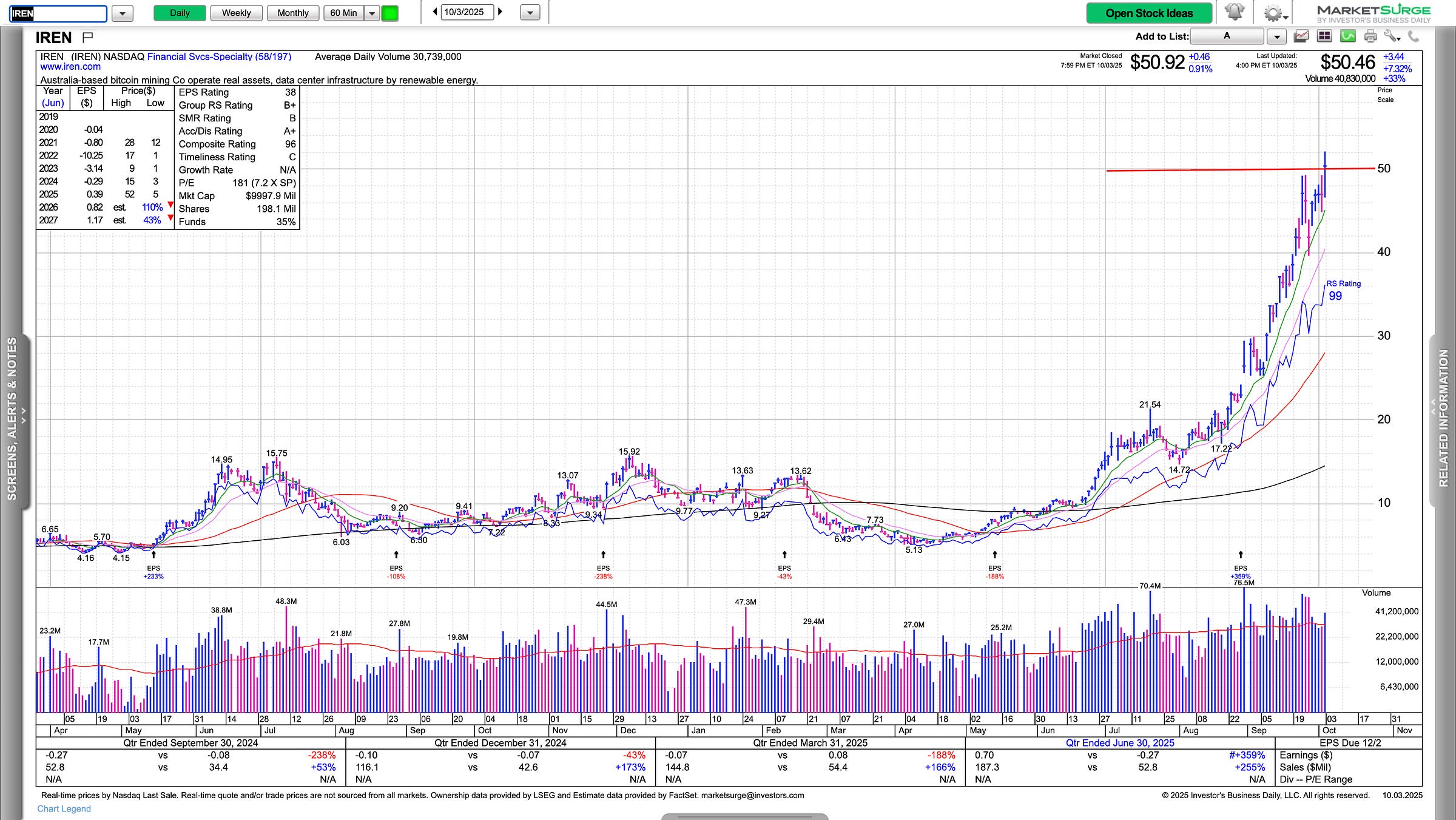

This is a bit of a stretch but as far as psychological price levels go, interested to see how IREN acts as it’s right at $50 and 10 billion.

That’s it—a quick read on the bellwethers to gauge where we are after an impressive lockout rally. With NVDA pressing toward $5T, PLTR flirting with $500B, TSLA potentially forming a weekly handle, and AMD coiling around the $163.12 pivot, leadership is approaching meaningful checkpoints. I remain structurally bullish, but I’m treating these milestones as confirmation gates: prepare for more volatility than we’ve had, prioritize quality/liquidity, and let price and breadth validate the next add.