🎢 Overarching Themes

Trend: Market in Uptrend.

Narrative: The AI Bubble thesis is intact but we’re at a critical check-in point.

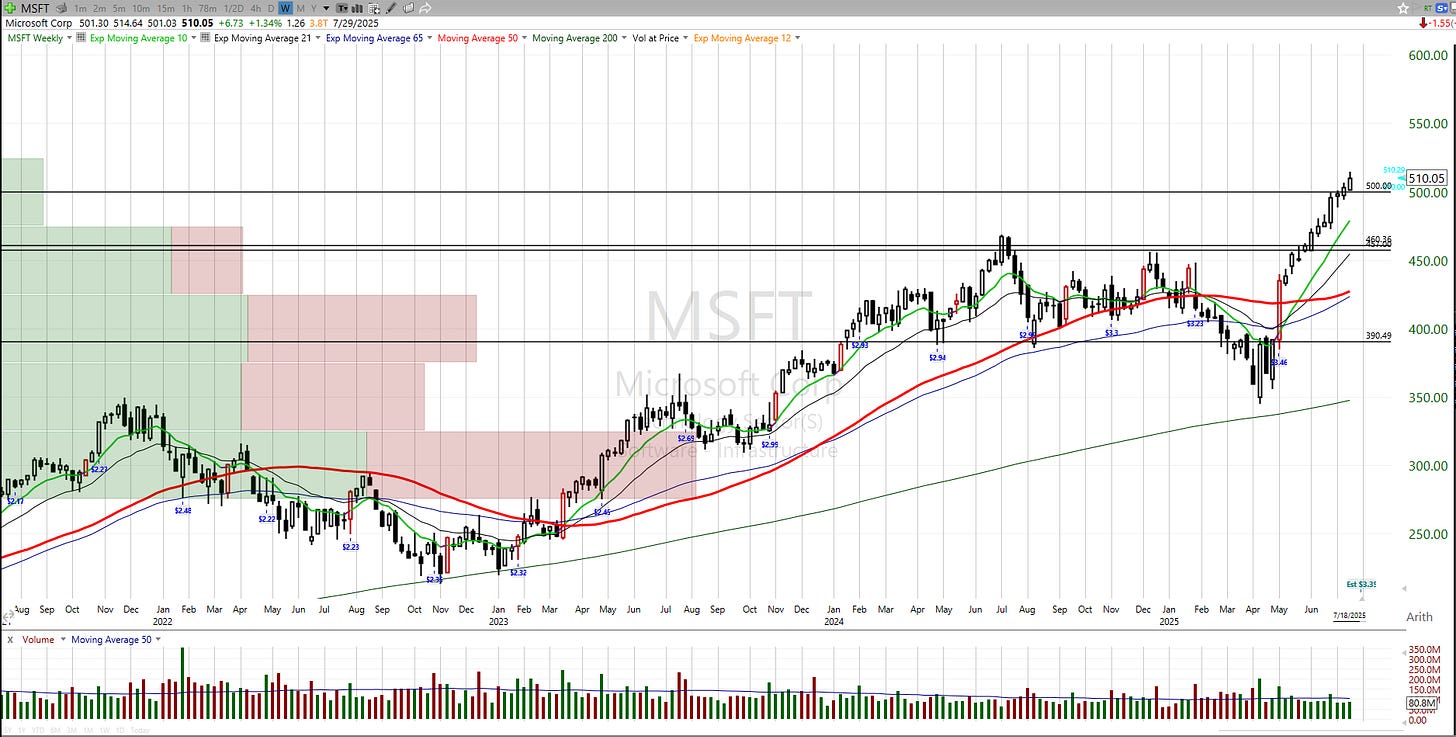

Market Cap Expansion 3 trillion & beyond: MSFT, NVDA, and AAPL.

Drivers: AI, robotics, crypto, cybersecurity, software — still leading.

📊 Weekly Themes:

Brace for a pullback but expecting character change if it comes.

Fine with a melt up but want to mentally prepare for a pullback.

Breath thrust of names pushing pivots?

AMD, HOOD, ALAB.

Nasdaq Composite $20,000, TSLA $350, NVDA $150.

These are the upside hurdles where our “AI Bubble” thesis comes alive.

📆 Earnings & Economic Calendar (Week of July 22–26, 2025)

This week could provide key catalysts — with major earnings from AI leaders, plus a full slate of economic data, including Powell's remarks and PMI updates.

🔊 Notable Earnings to Watch:

TSLA – Focus on AI, robotics, and global demand signals

GOOGL – Key read on AI ad spend, cloud growth, and search dynamics

NOW (ServiceNow) – Enterprise AI adoption leader

TXN (Texas Instruments) – Semiconductor demand bellwether

LMT (Lockheed Martin) – Defense AI and geopolitical positioning

INTC (Intel) – Can it reclaim relevance in the AI chip race?

CMG (Chipotle) – Consumer strength + pricing power insight

UNP (Union Pacific) – Rails = macro demand read

📊 Key Economic Events:

Tuesday: Fed Chair Powell speaks — possible rate or policy clarity

Thursday:

Initial Jobless Claims

Manufacturing & Services PMI (Jul)

New Home Sales

Friday: Durable Goods Orders – watch for signs of industrial momentum or slowdown

💭 Thoughts

Mentally prepared for a pullback but what we have expected here is taking place so not overthinking here and letting price run as it can.

📈 Market Indices

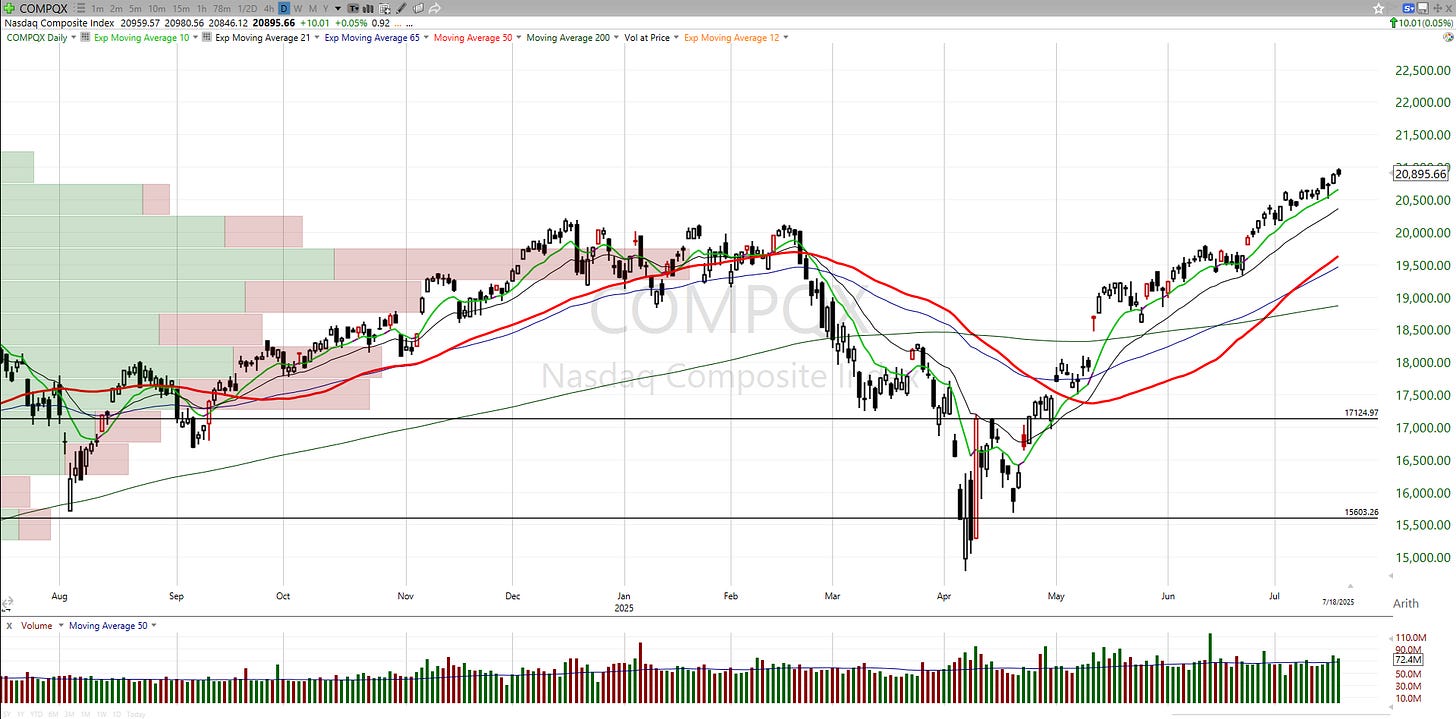

We’ve been calling 20,000 on the Nasdaq a pivotal level for eight months — and now we’ve finally broken and held above it. This confirms our broader thesis and lines up with the 1998-style “lockout rally” we’ve been discussing.

That setup appears to be unfolding exactly as expected.

This is why I’ve kept things simple: focus on major inflection points, avoid noise, and let price confirm. The weekly chart supports that — we don’t look like we’re topping. Sure, a pullback is possible and we should be mentally prepared, but there’s no breakdown in character or structure yet.

The reason I’ve leaned into terms like “AI bubble” and “lockout rally” is to avoid getting shaken out of what could be a historic run fueled by AI and mega-cap leadership. These moves often stretch further than most expect — and punish early exits.

If the bubble does continue to expand, it’s not unreasonable to start thinking about the Nasdaq pushing toward 50,000 over the next few years

🏢 Institutional Stocks

It’s been a mixed bag, but there’s been no shortage of strong performers within the institutional cohort. Many names are still leading and trading near all-time highs — showing clear signs of relative strength. You know how we had that whole 3 trillion market cap expansion theory? My thought is that we may be seeing the 2 trillion names start to act as magnets towards 3 trillion.

This week, we’ll hear from two key players:

GOOGL, a critical read on AI monetization and cloud

TSLA, the wildcard with potential to re-anchor the AI + EV narrative

How these two report — and how the market responds — could set the tone for the rest of the group as earnings season unfolds.

GOOGL here basically just a base, what I want to see and a bit of speculation I have around earnings is if we get a gap up, I think it may be one that can run to that 3 trillion market cap relatively quickly. If we get a gap down, will let the high volume close from the following days guide us.

AAPL structure has improved but it’s really just milling around. It’s holding 3 trillion market cap which is good but has yet to get into the right side of this base.

MSFT nice push past $500, has barely had a down week since April ish, hard to be too negative with this action going on. With that being said, reasonable to anticipate a pullback, if we see one come that holds $500 that would be impeccable strength.

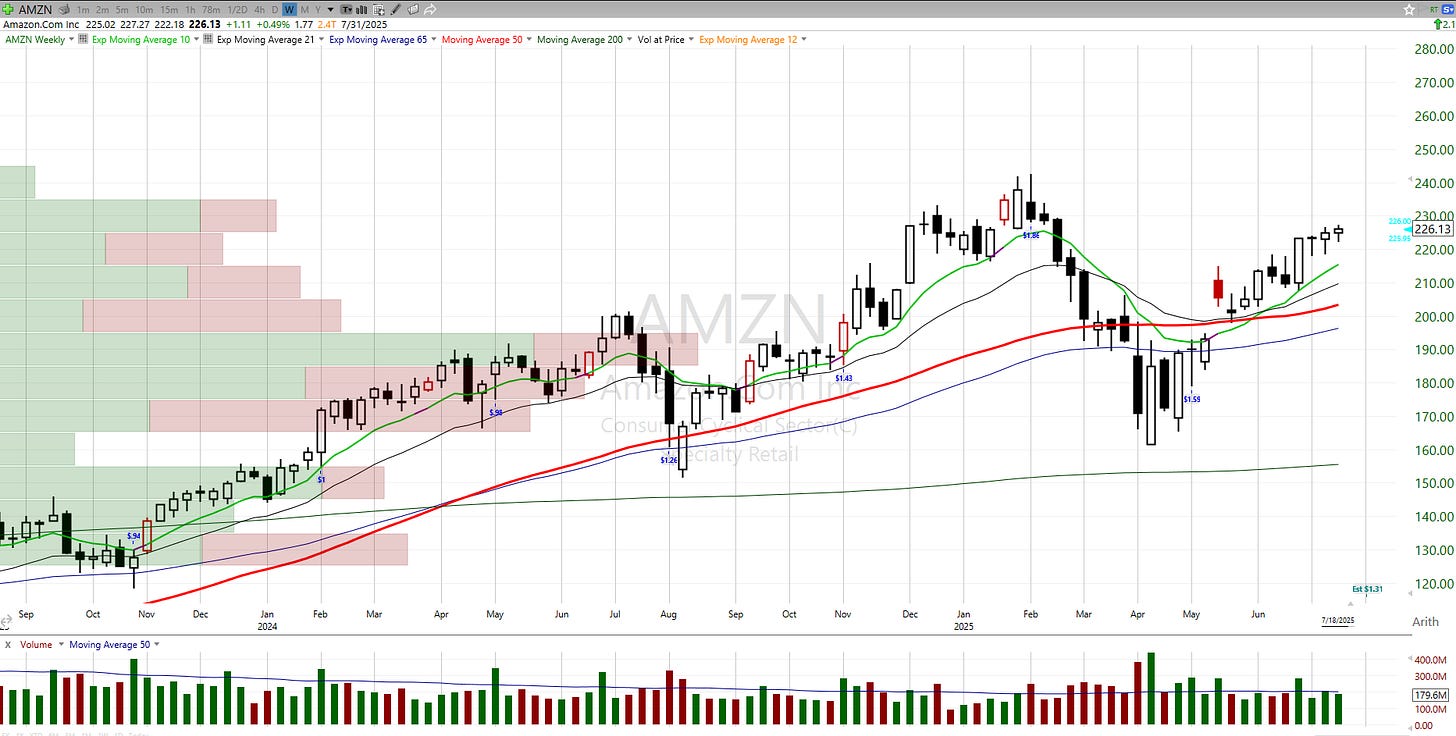

AMZN pushing the right side of a mini base, weekly chart shown, looks excellent here.

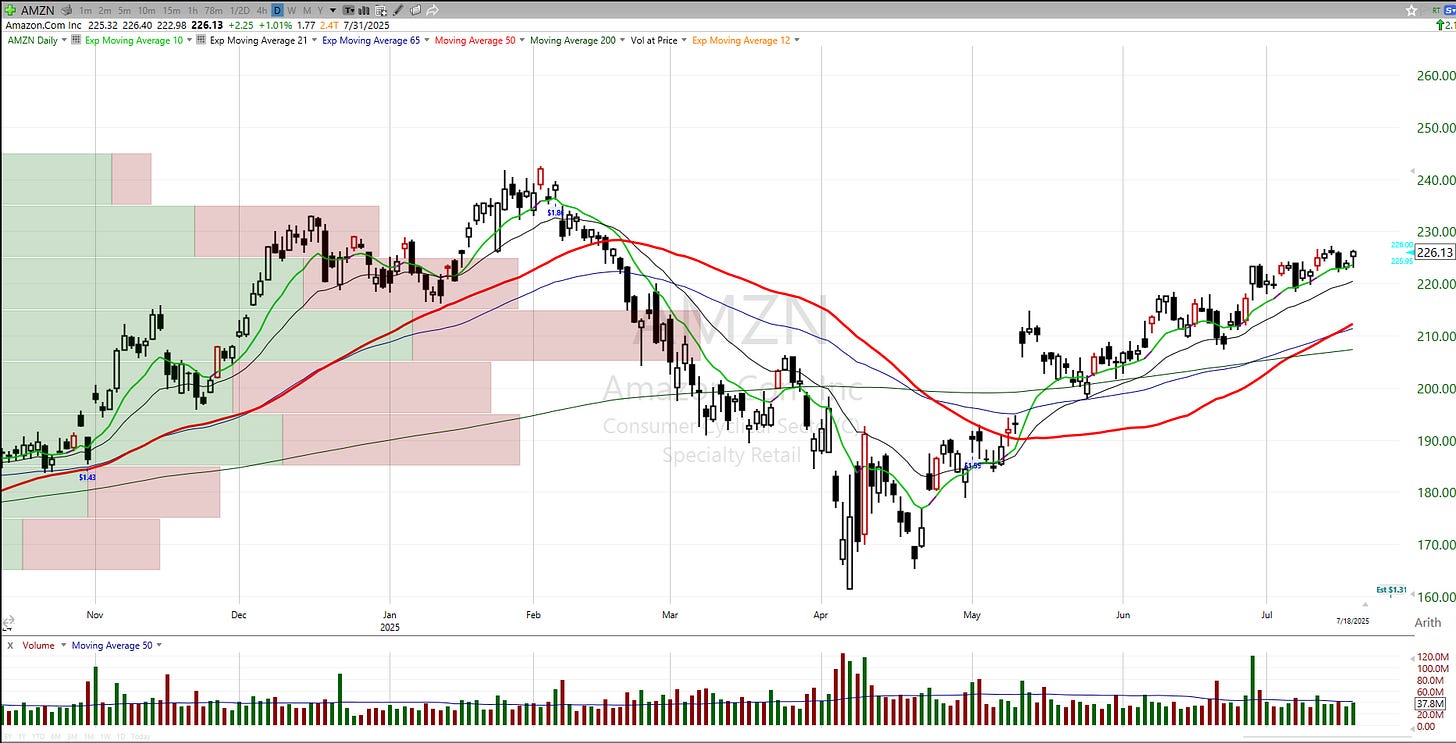

Let me also share the daily on AMZN as character change has been a major theme, the stock is just riding up the 10/20 day here as many other names are doing as well. So for AMZN and others, if we get a pullback to those areas, it’s business as usual.

NFLX had been running hard so nothing too crazy here but pulling back a bit and we have a HVC to monitor here.

META first break of the 20 day from the April lows, let’s watch and see how it plays out here.

AVGO leading the charge with the other major semiconductors.

TSM reported last week but unable to hold it’s high volume close instantly after earnings. Nothing to panic about but something to keep an eye on.

NVDA since the break of the pivotal point of $150 has been full steam ahead. Character change if it starts to pullback is my thought.

🚀 Growth Stocks

We’re starting to see things mature in the growth space. While we haven’t had that full “all-go” moment yet, the leaders continue to grind higher, and we’re seeing new names push through pivots daily.

That said, I still favor the strategy we’ve been leaning into: holding core names rather than chasing every breakout. Focused exposure tends to outperform scattered attempts in a melt-up.

Here’s where I remain focused:

Core AI Names:

TSLA, NVDA, AMD, PLTR

Crypto-Adjacent Leaders:

HOOD, COIN, MSTR

We’ll walk through setups and structure on these below — but this remains my “A-tier” list while we ride the broader AI and digital asset wave.

NVDA since the break of the pivotal point of $150 has been full steam ahead. Character change if it starts to pullback is my thought.

TSLA reporting this week, got a bit tight here near the lows before pushing the 50 day, hasn’t yet started the right side of its base, I think the all go is $350 to the upside. The good news is it continues to hold the 1 trillion market cap.

AMD cleared the $148 level here, it’s been character change all along the way so may pullback as its been. A small high volume close on the gap at $155.61, if holds that would be excellent. In the grand scheme of things, its still a ways from all time high breakout.

PLTR push to all time highs.

COIN nice little push over 100b and all time highs test, big wick so a little back and forth with that level but something to watch over the 100b market cap.

MSTR a Bitcoin play which I think is headed much higher and anticipate MSTR will as well.

HOOD nice push through $100 and now about 4% away from 100b market cap, perhaps a base here, but thinking it may have more juice in the lemon.

GLXY a little bonus here, push to all time highs here and crypto related.

Additional names:

NET nice little consolidation and now trying to continue.

SE similar to NET, into 100b market cap here.

ALAB consolidation now above the HVC and slight push here above $100, failed a few times but seems ready this time, think this has a lot of potential.