🎢 Overarching Themes

Trend: Market in uptrend.

Narrative: AI Bubble thesis intact; another check-in week.

Market-Cap Expansion (>$3T): MSFT, NVDA, AAPL.

Drivers: AI, semis/compute, cybersecurity, software, robotics, crypto—still leading.

📊 Weekly Themes

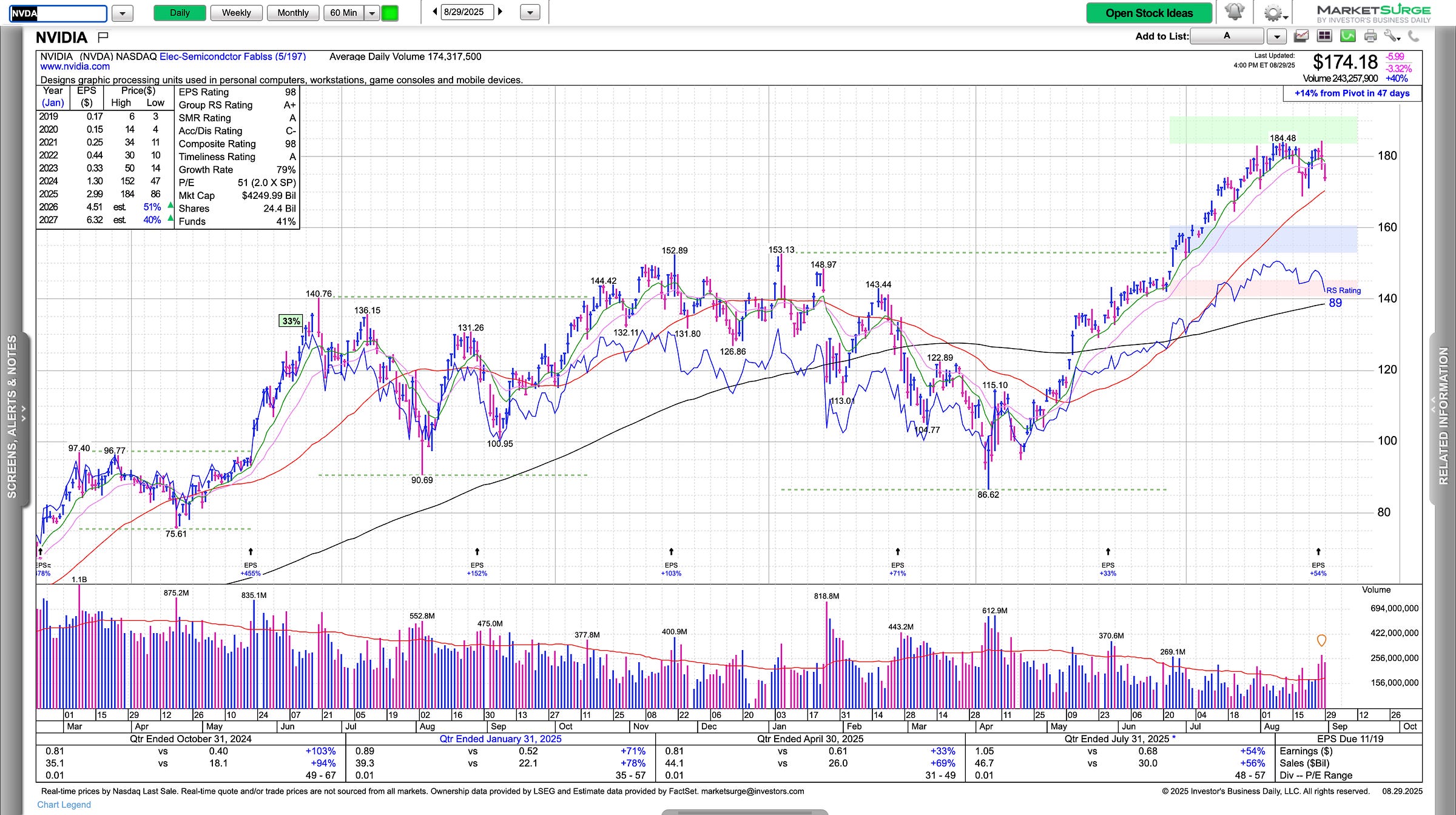

NVDA’s ability to hold the 50 day.

Upper pivots need to be reclaimed.

Mega-caps steady; breadth is the swing factor.

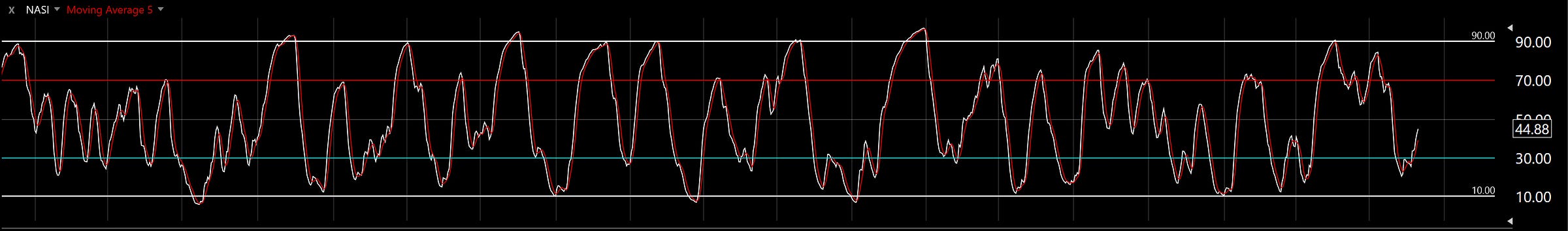

NASI possible power wave building.

🗓️ Key Earnings to Watch

ADBE (Adobe) – Big cap software; always a read-through on enterprise spend.

SNPS (Synopsys) – Critical in the semis/EDA pipeline; AI design leverage.

KR (Kroger) – Consumer defensive check on grocery/food inflation.

CHWY (Chewy) – E-commerce discretionary gauge.

GME (Gamestop) – Speculative retail sentiment barometer.

AVAV (AeroVironment) – Defense/robotics tie-in.

PL (Planet Labs) – Space/earth-imaging play, small but thematic.

TEN (Tsakos Energy Navigation) – Energy/shipping signal.

AMRK (A-Mark Precious Metals) – Niche but ties into metals/crypto sentiment.

🏛️ Key Economic Data

Tuesday (Sep 2): Manufacturing PMI, ISM Manufacturing (PMI + Prices)

Wednesday (Sep 3): JOLTS Job Openings

Thursday (Sep 4): ADP Jobs, Initial Claims, Services PMI, ISM Non-Manufacturing (PMI + Prices), Crude Inventories

Friday (Sep 5): Avg Hourly Earnings, Nonfarm Payrolls, Unemployment Rate

Thoughts:

As we look ahead, the main theme remains unchanged from what we’ve been tracking over the last couple of weeks: this is a moment where patience pays. If you’ve been leaning too heavily on leverage, you’ve probably already got the hint from last few weeks to pair it back and allow the market to digest the recent move. What we’re waiting to see is whether a true base forms on the horizon—maybe it’s short, maybe it drags on longer, or perhaps it’s just a quick shakeout. The important part is to be prepared for all three outcomes rather than assume one.

The NASI is beginning to turn up into an area that could unleash a genuine power wave higher, but I want to temper that optimism with caution. This is exactly the type of level where it makes sense to let the market prove itself before we lean in aggressively. That means waiting for upside hurdles to be taken out and confirmed, rather than anticipating them and getting caught in unnecessary drawdown.

For those not over-leveraged and already sitting on respectable gains, holding makes sense. I’m not bearish here and still see plenty of potential upside. But this is less about outright direction and more about portfolio construction—knowing what kind of drawdown your positions can withstand and making sure you’re comfortable with that risk.

At this stage, I don’t have ultra-high conviction in one outcome over another—whether the next chapter is a base, a drawdown, or the launch of a power wave. The information we need will reveal itself in the price action soon enough. Until then, a defensive-leaning posture, paired with patience and discipline, remains the smart play.

NASI: Building towards powerwave, proof is in upside hurdles getting taken out.

Market Indices:

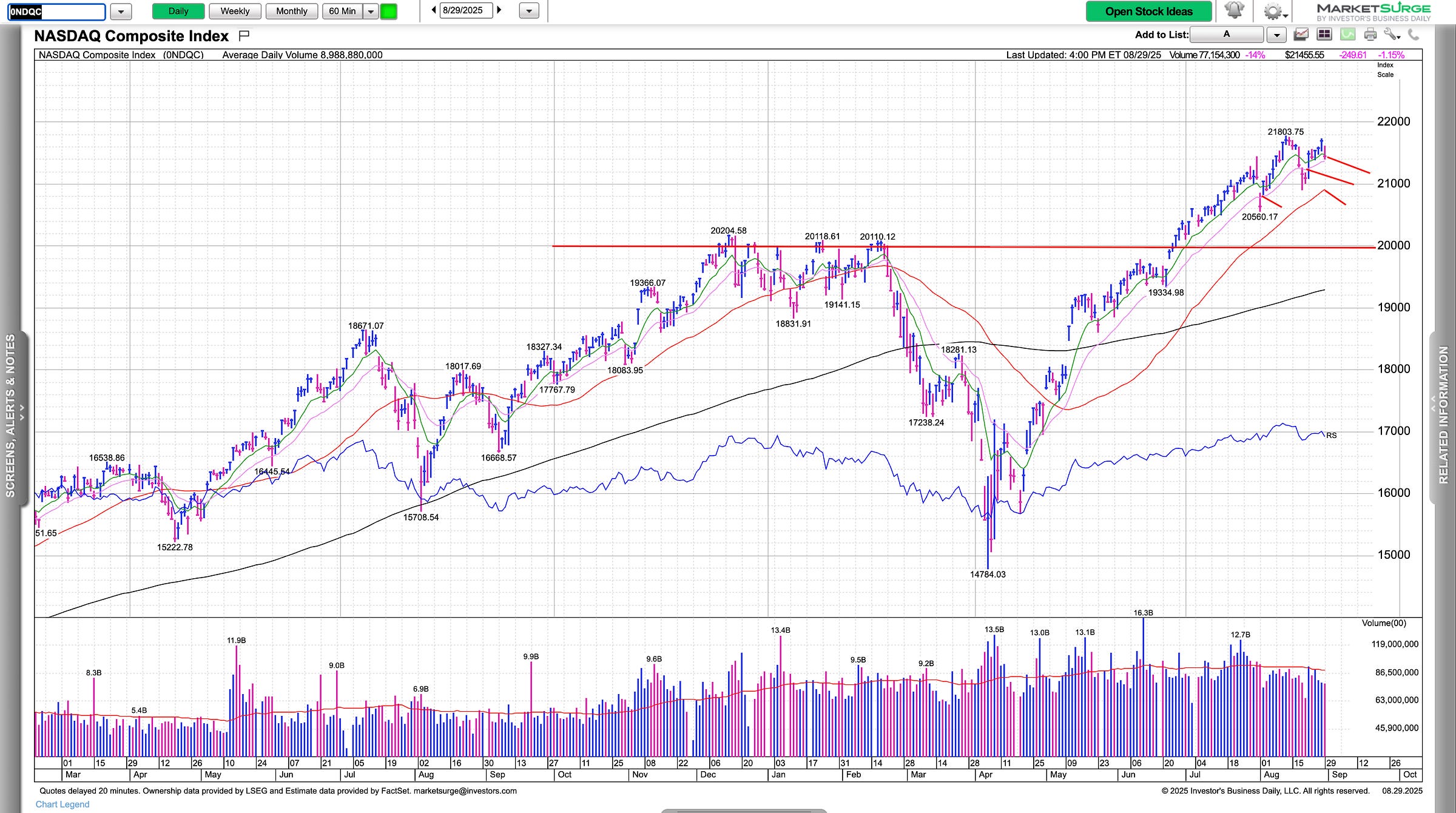

The focus remains firmly on the Nasdaq Composite, with $20,000 and beyond still the overarching roadmap. We’ve had a strong, quick move higher riding the 10- and 20-day averages, but volatility has started to pick up. There have already been a couple of sharp breaks below the 20-day that were quickly reclaimed, and now the index is heading back in to test that level again.

The 50-day isn’t far beneath, so a retest and even a brief break of that zone is very much in the cards. These aren’t signals of panic, but they are important markers to watch. The takeaway here is more about being aware of the potential for near-term turbulence and adjusting portfolio exposure if necessary, rather than overreacting. The broader trend remains intact, but this is a point where the market may need to pause and consolidate before attempting the next leg higher.

Institutional Stocks:

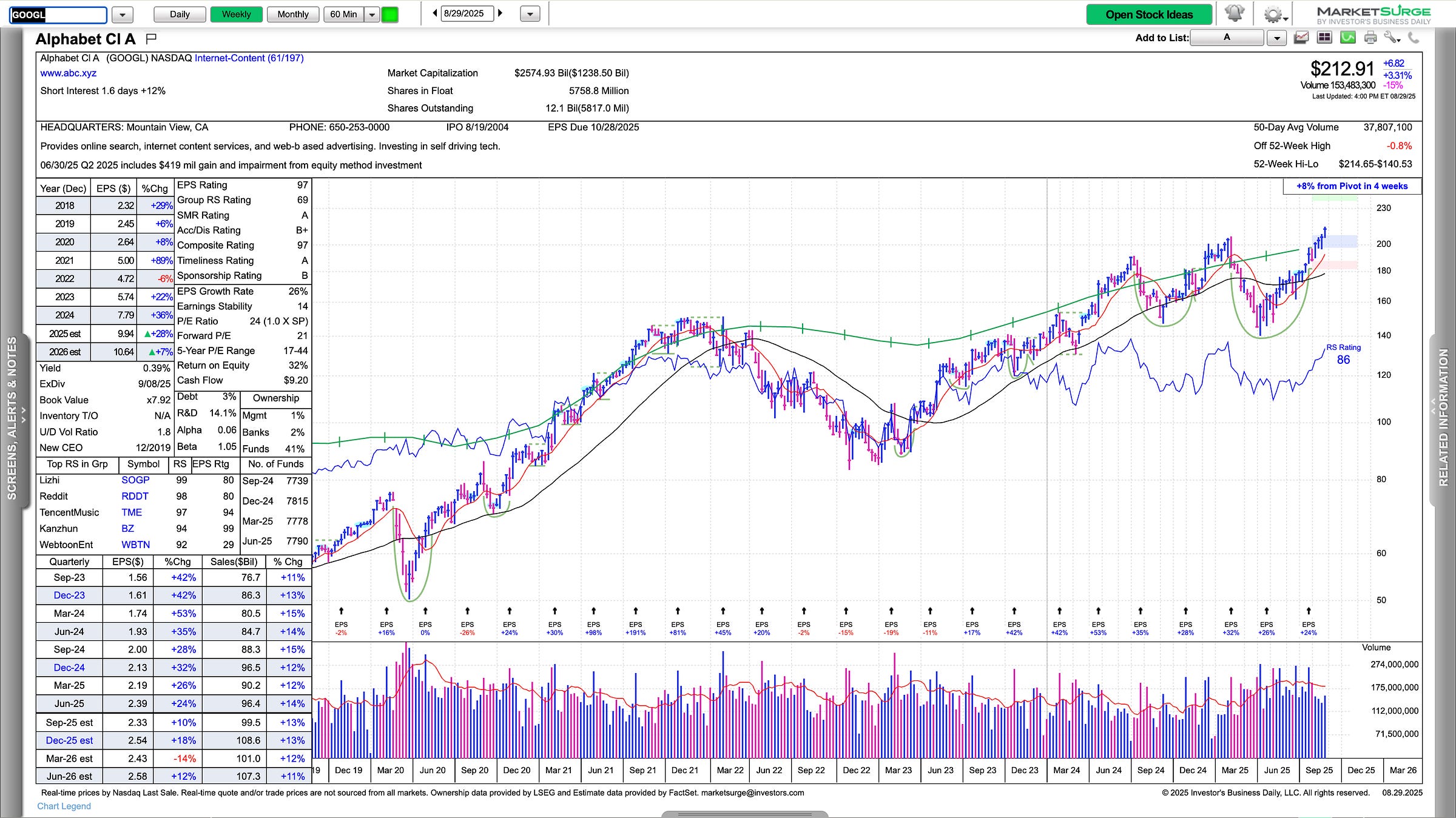

Institutional leadership remains a bit underwhelming—setups are decent, but we’re still not seeing clean breakouts across the board. Google has begun to push, which is encouraging, but the broader group needs to follow suit if we’re going to get meaningful confirmation. The overarching theme continues to be market-cap expansion.

We watched the three-trillion-dollar trio make their push toward four, and since then it’s largely been a digestion phase. The open question is whether five trillion becomes a ceiling or just another checkpoint. My inclination is that if we do push through five, then ten trillion becomes a realistic destination, which fits squarely within the broader AI Bubble theme I’ve been laying out. The psychology also aligns—if the consensus believes we’re in a bubble already, odds are we’re not there yet.

There is some concerning action, into key moving averages from below, in the short term, could mean another leg down, something to be aware of and aligns with our short term caution but long term optimism. By short term optimism I mean a few weeks possibly but as I mentioned, we have NASI building towards a power wave so we will see what clues we get this week.

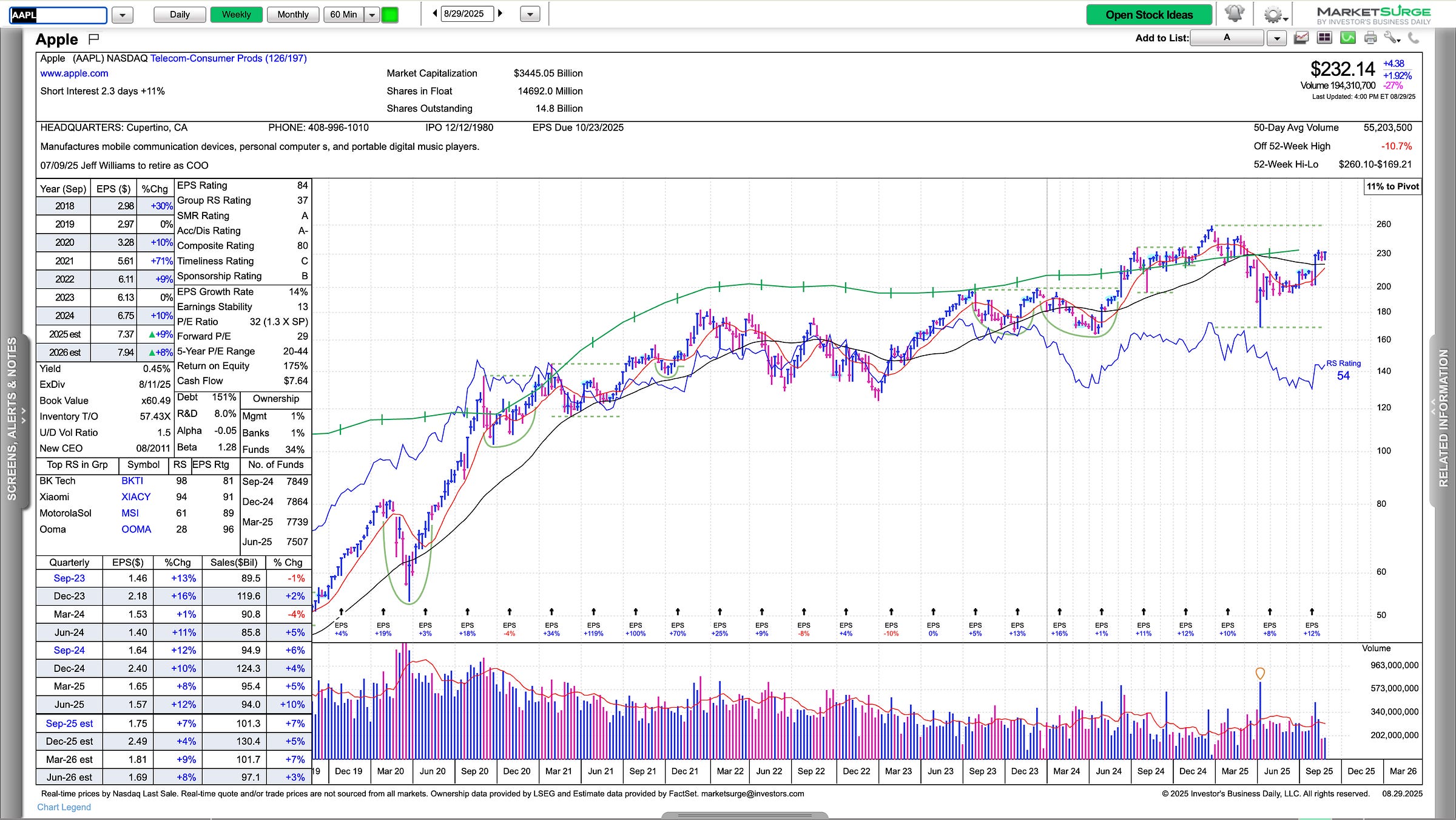

AAPL decent, nothing too exciting but setting up for a possible breakout, AAPL event in a couple weeks, frankly think it’ll be a hit.

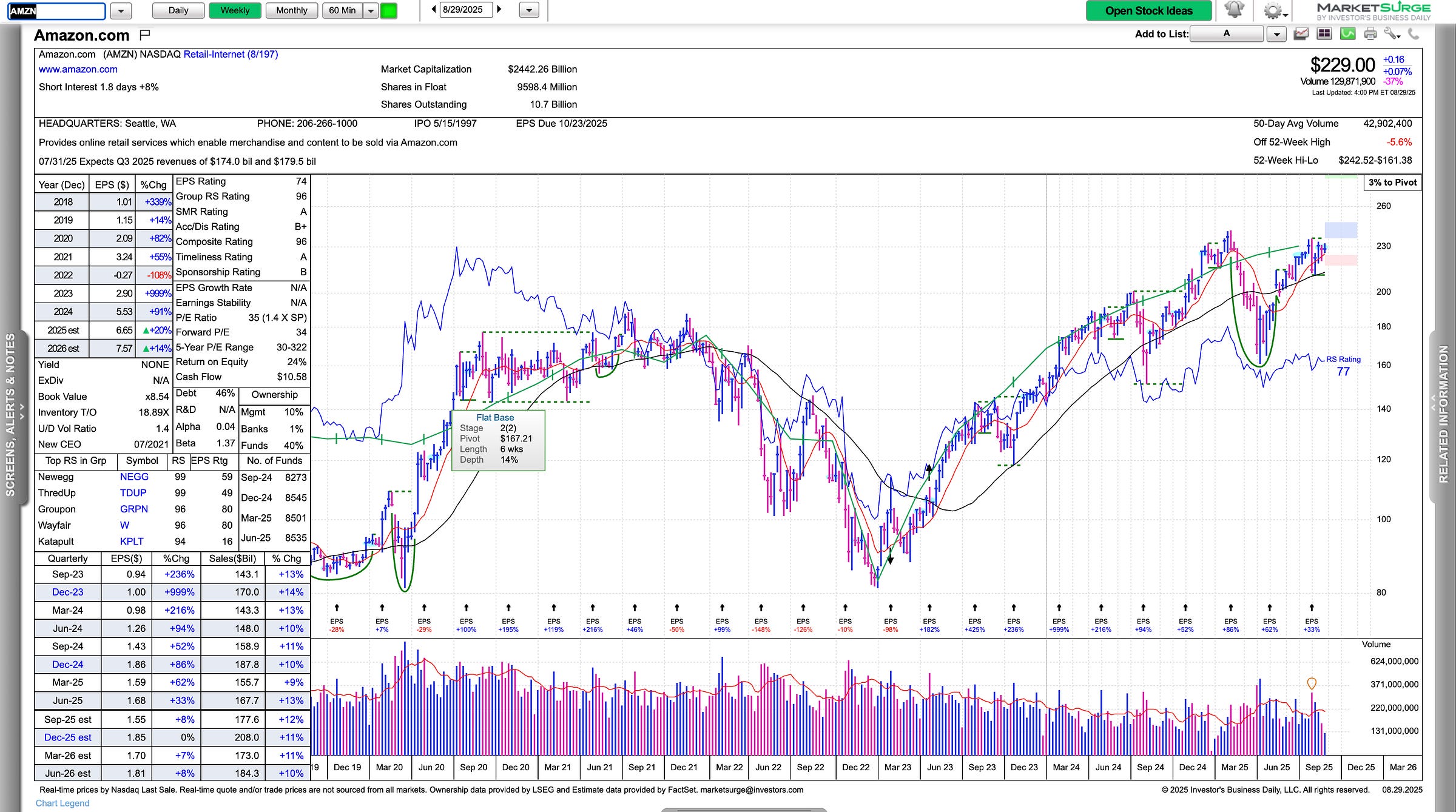

AMZN a bit better that others, this one has frankly been slow motion so I do want to see some power out of this one following the breakout, I am going to assume that to be the case for now but we shall see as it makes it closer to that pivot.

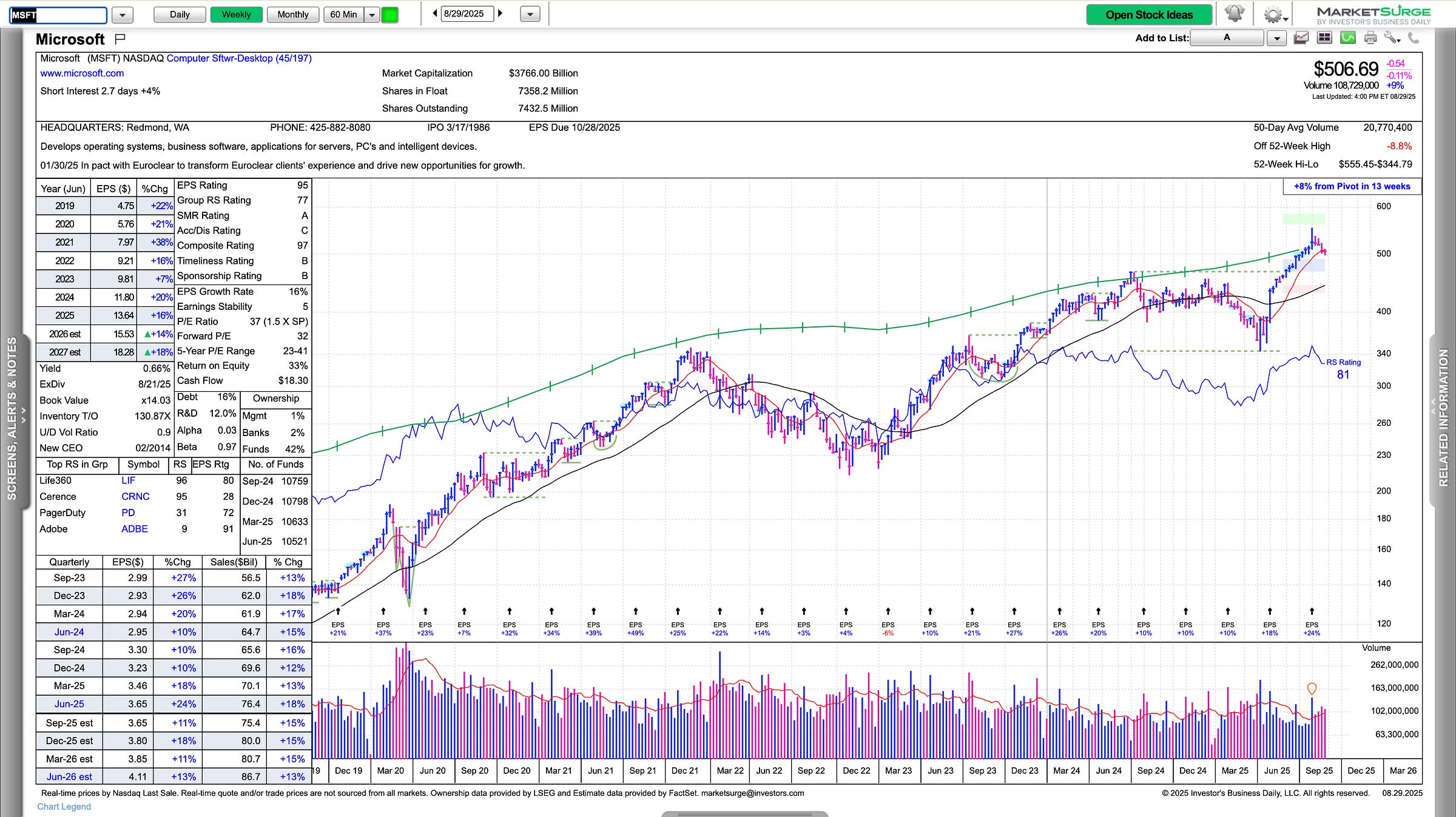

MSFT hanging onto the $500 level, like to see this action, if continues to do this, decent sign for AI and mega caps.

GOOGL breakout, great sign, we just want to see more action like this, think GOOGL has room to $240ish, pretty much would say buy the dip till then.

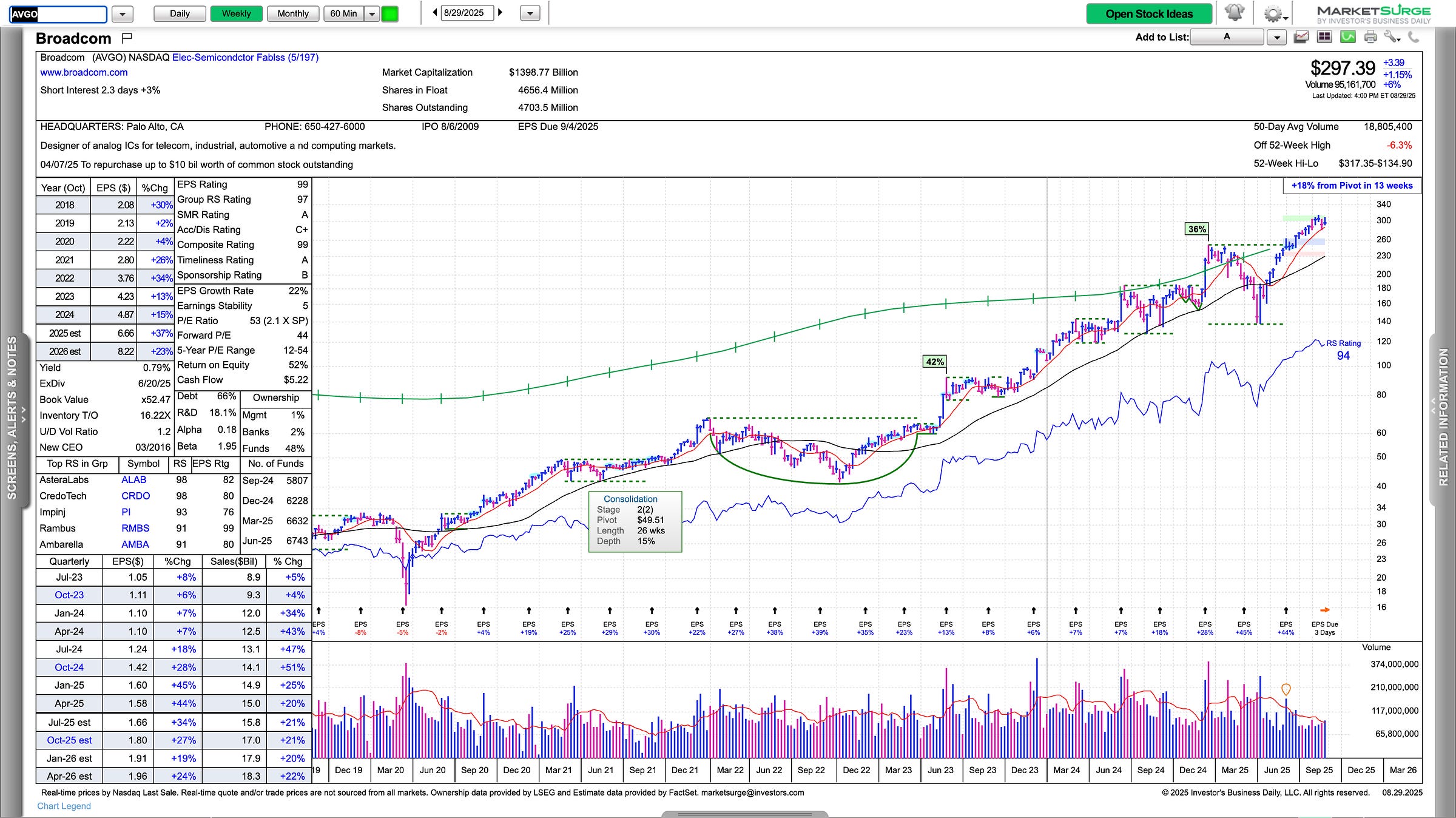

AVGO been riding the breakout higher, reports this week, should be a good indication for semis going forward.

Growth Stocks:

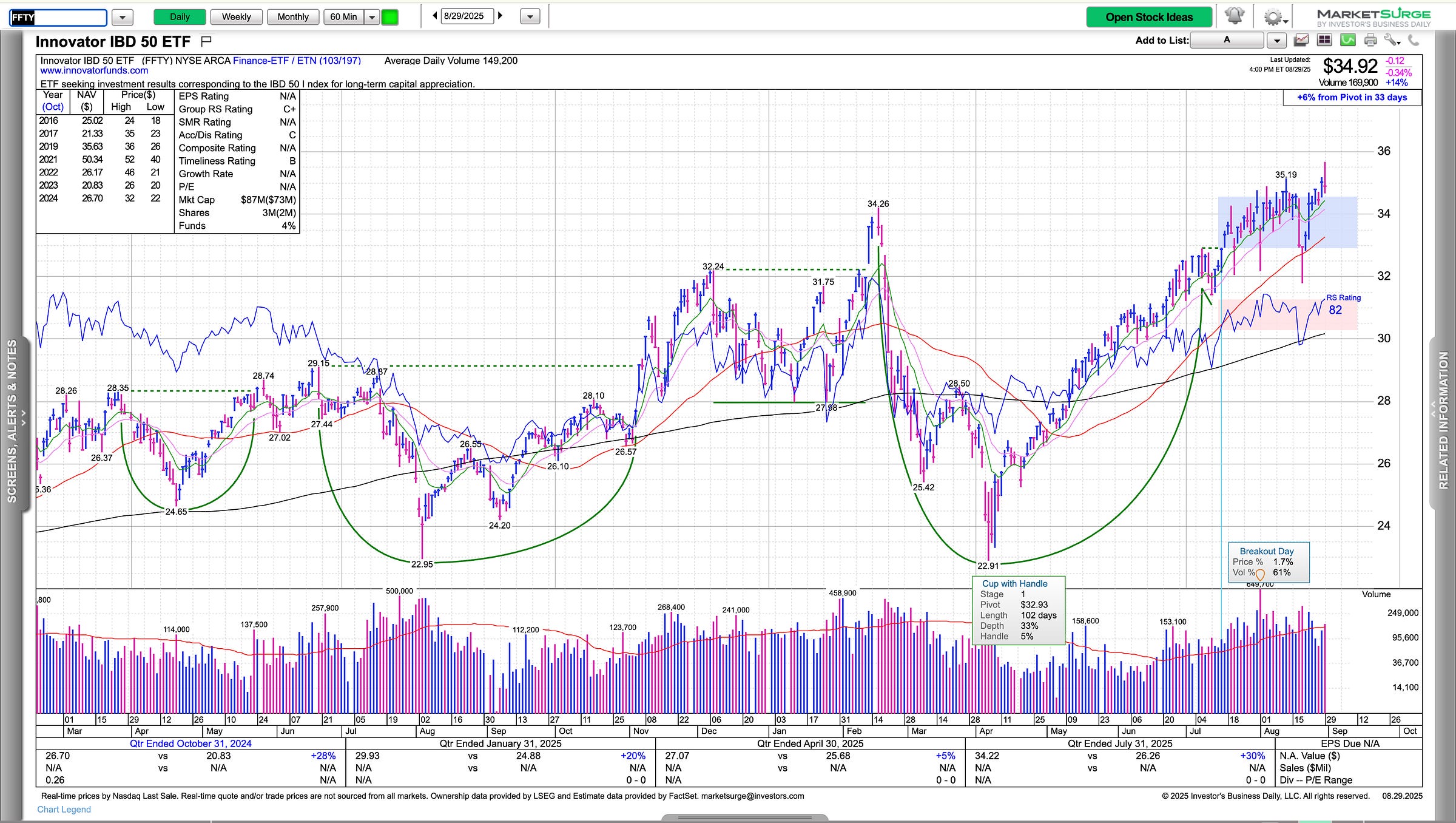

The cohort has been on a clean move higher, more recently last few weeks we saw heightened volatility, even a fresh breakout that failed Friday. If we get this breakout, more inclined to say possible signal of power wave but we shall see, if we get another move lower towards the 50 day, potentially more inline with a base here.

NVDA has been our lead indicator for the AI bubble, a bit dull last few weeks including it’s earnings reaction, no 50 day test since may, perhaps we get a mini base here or shakeout on the horizon. Big thing here is it’s not far off from 5 trillion market cap so we want to be again just aware and cautious of what can occur here, overall its still fine.

TSLA and $350 still not getting alone, want to see it hold a bit before we can feel good about an imminent move. Prefer to see it hold 20 day and 1 trillion market cap here. Still think this is cheapest AI name out, not really saying cheap based on valuation and more so just potential move.

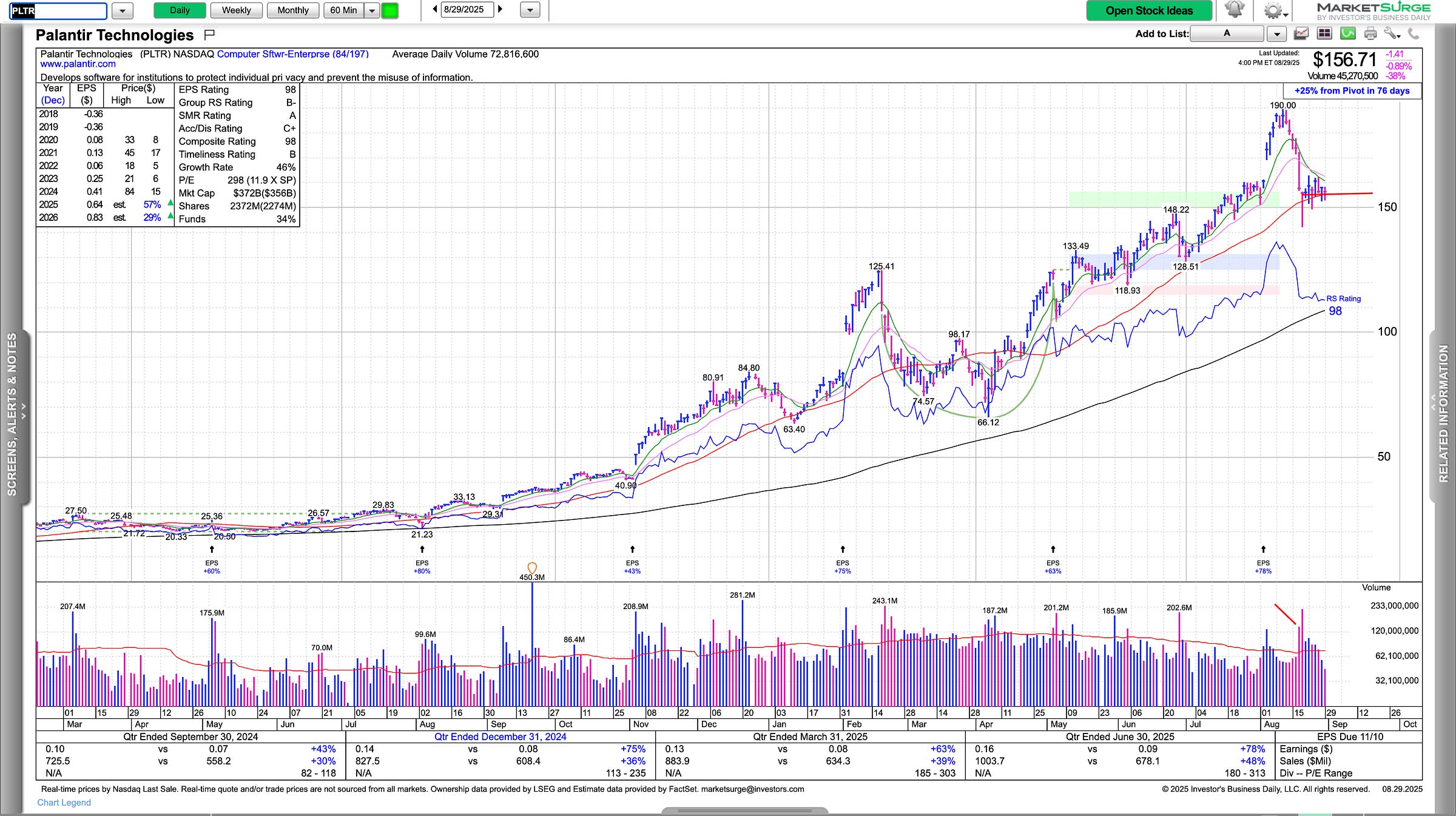

PLTR has it’s sharp downside move, it’s holding the downside high volume close but I dont really love this sideways action, prefer either hold or v shape quickly. We shall see but wouldn’t try to be a hero here, want to see if PLTR participates in the move higher.

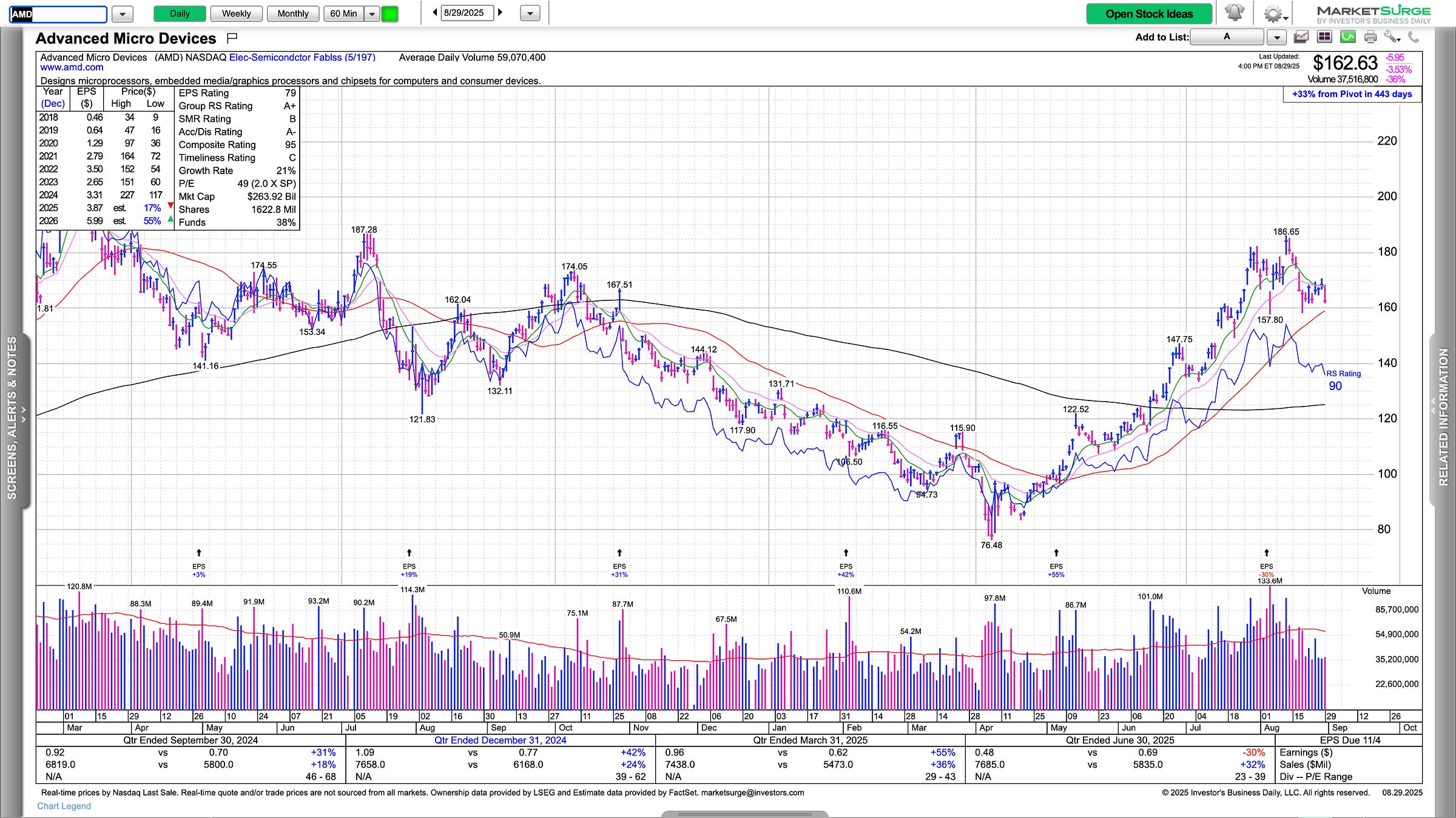

AMD has been plagued by the $168 level and continues to be, continues to sit above the 50 day so may just a short digestion here, through $174 AMD should be good to go for a breakout is my thought.

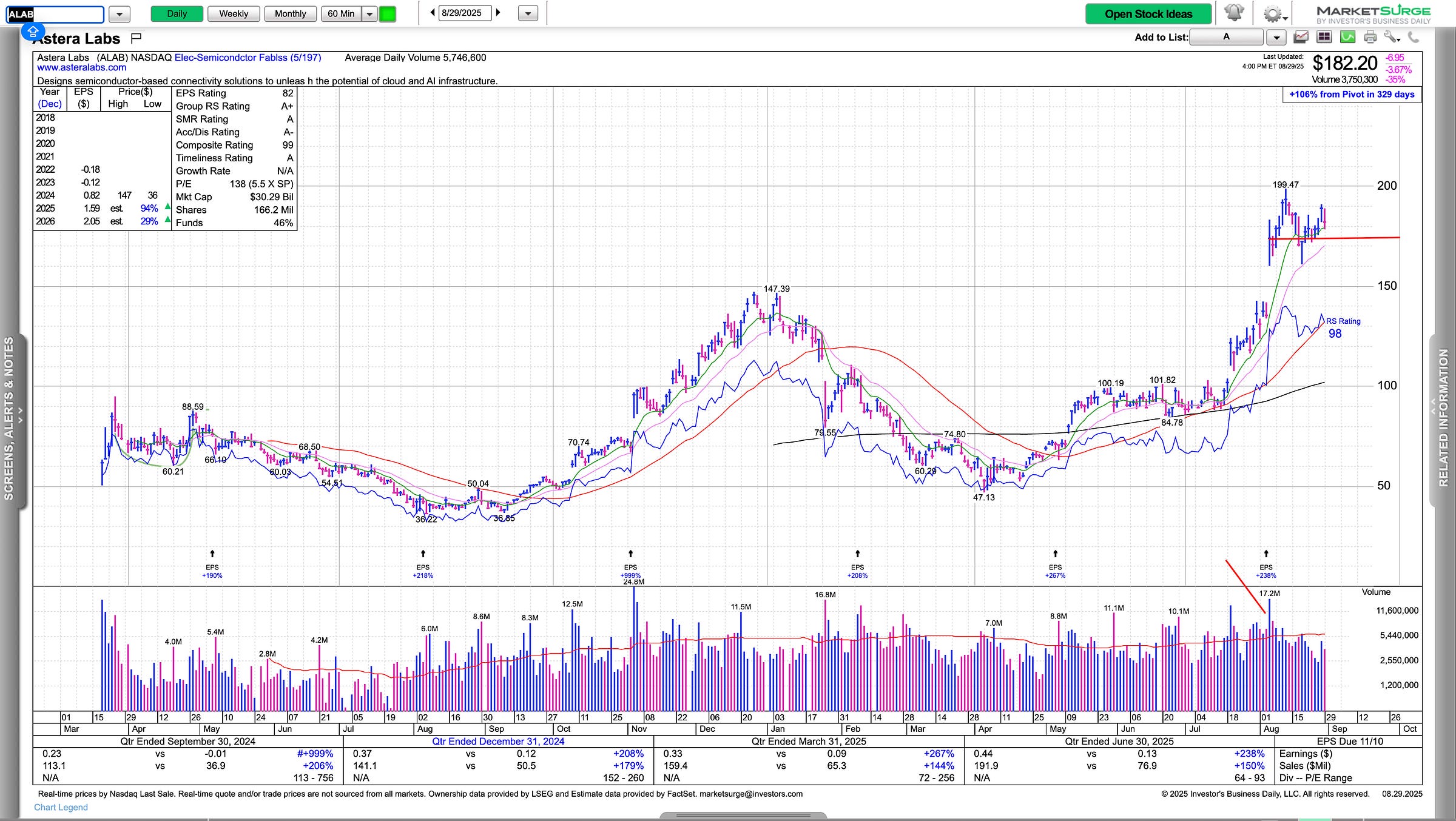

ALAB continues to be a favorite for me, one of the few holding onto upper levels still.

Since my conviction is lower here, lets keep the list short and sweet on names until we see upper pivots taken out and see which names prove themselves.