🎢 Overarching Themes

Trend: Market in uptrend.

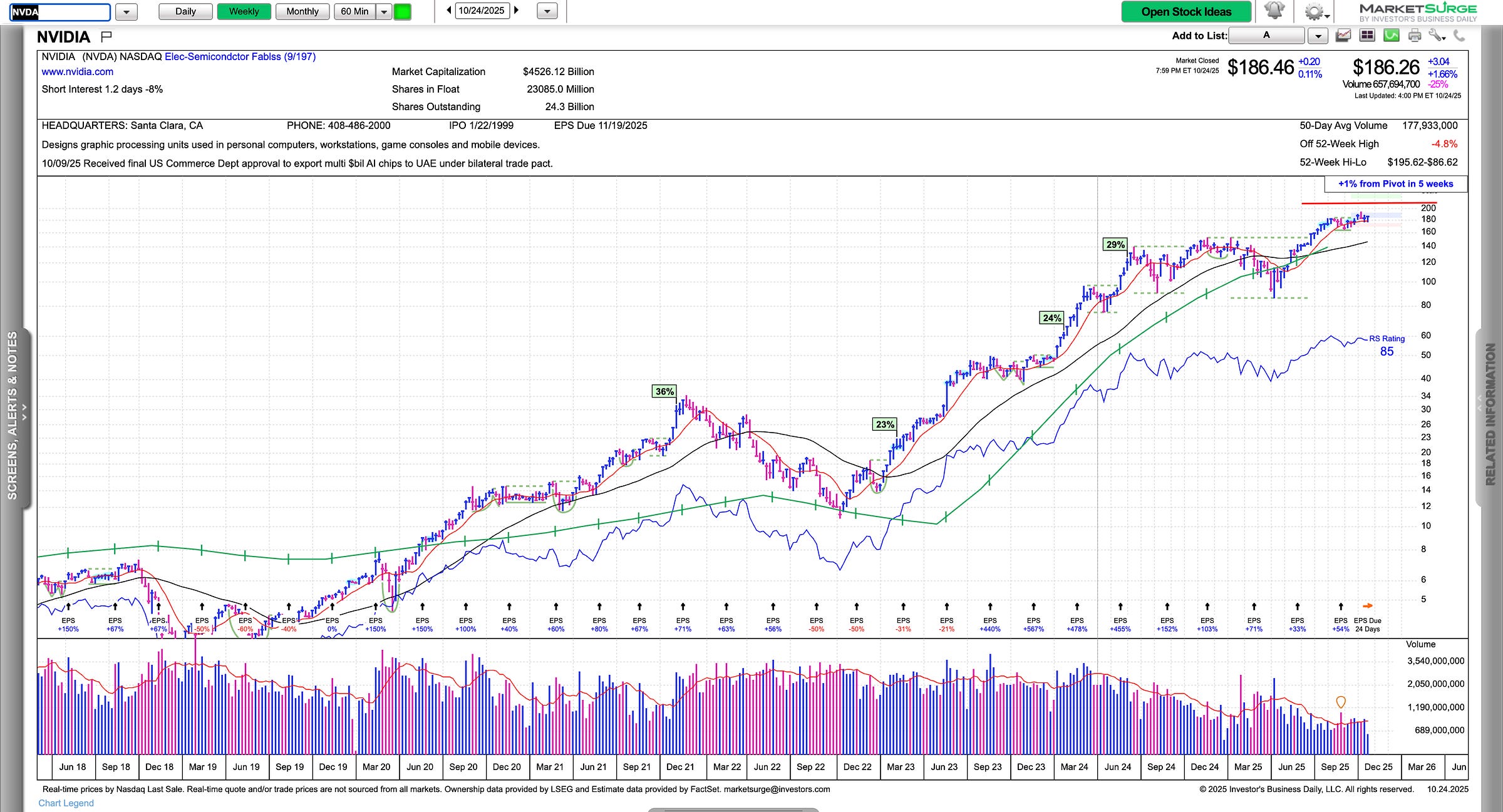

Narrative: AI Bubble thesis intact

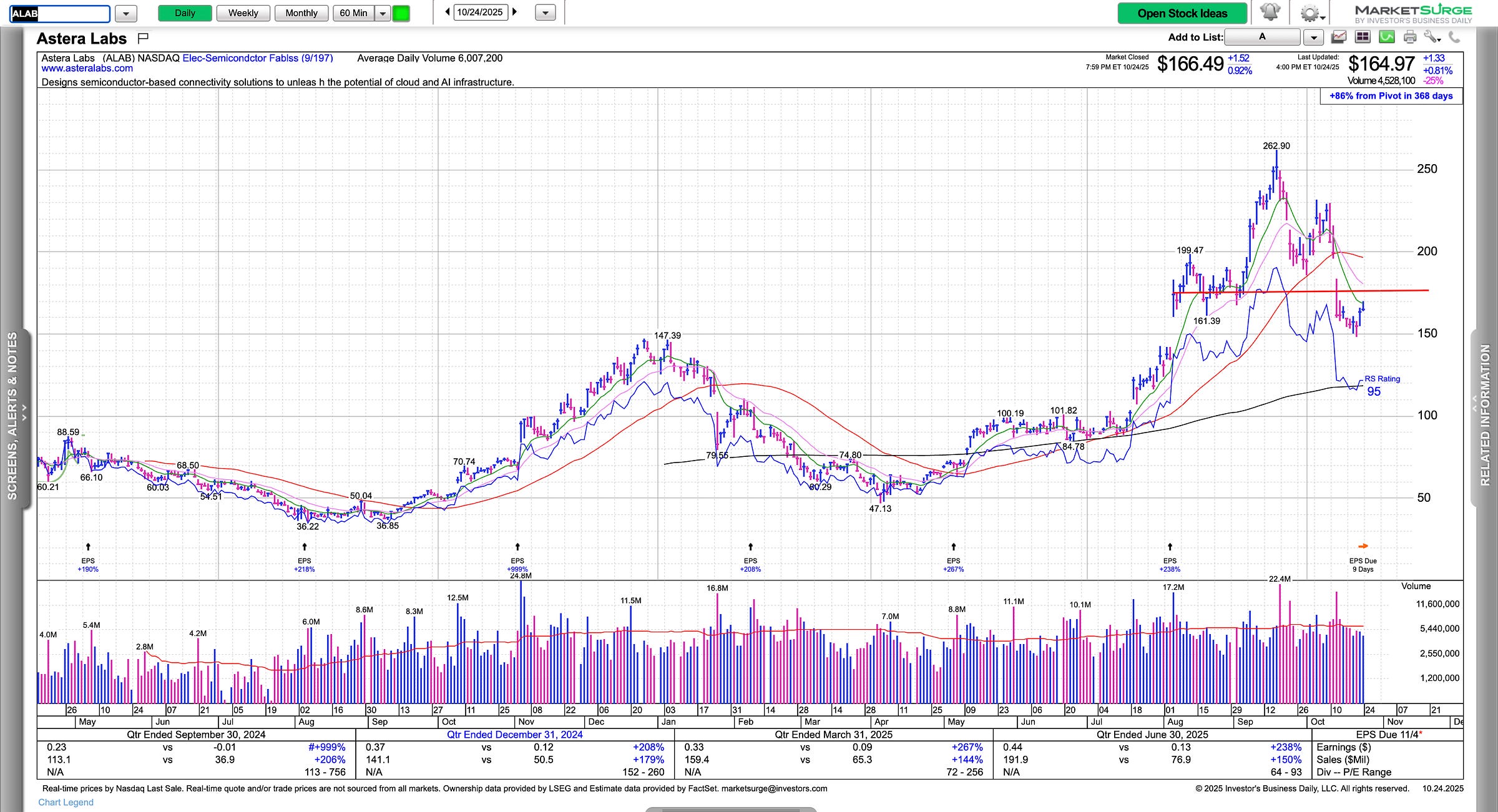

Drivers: AI, semis/compute, cybersecurity, software, robotics, crypto—still leading.

Market-Cap Expansion: 3 trillion market cap to 10 trillion.

📊 Weekly Themes

MegaCap earnings and GDP

NVDA 5 trillion market cap.

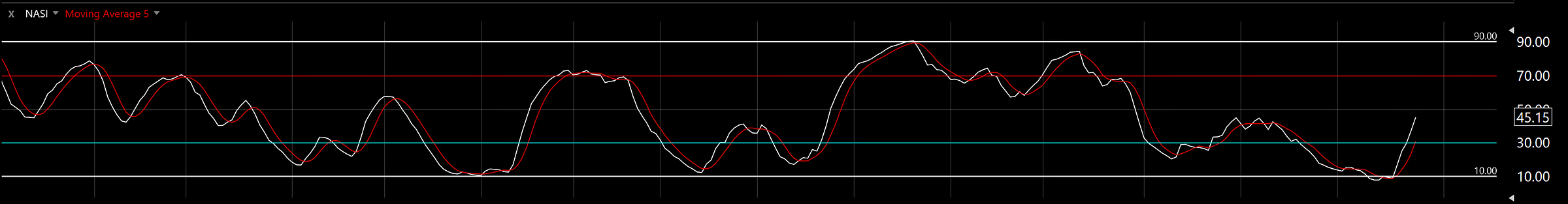

NASI possible power wave building.

🏛️ Key Economic Data – Week of Sept 16

Mon 10/27: Durable Goods (Sept), New Home Sales (Sept)

Tue 10/28: CB Consumer Confidence (Oct)

Wed 10/29: Crude Oil Inventories, FOMC Statement + Rate Decision + Press Conference

Thu 10/30: GDP (Q3)

Fri 10/31: Core PCE (Sept) YoY + MoM

Focus: Mid-week Fed decision anchors the week; GDP and PCE round out inflation + growth picture.

💼 Earnings

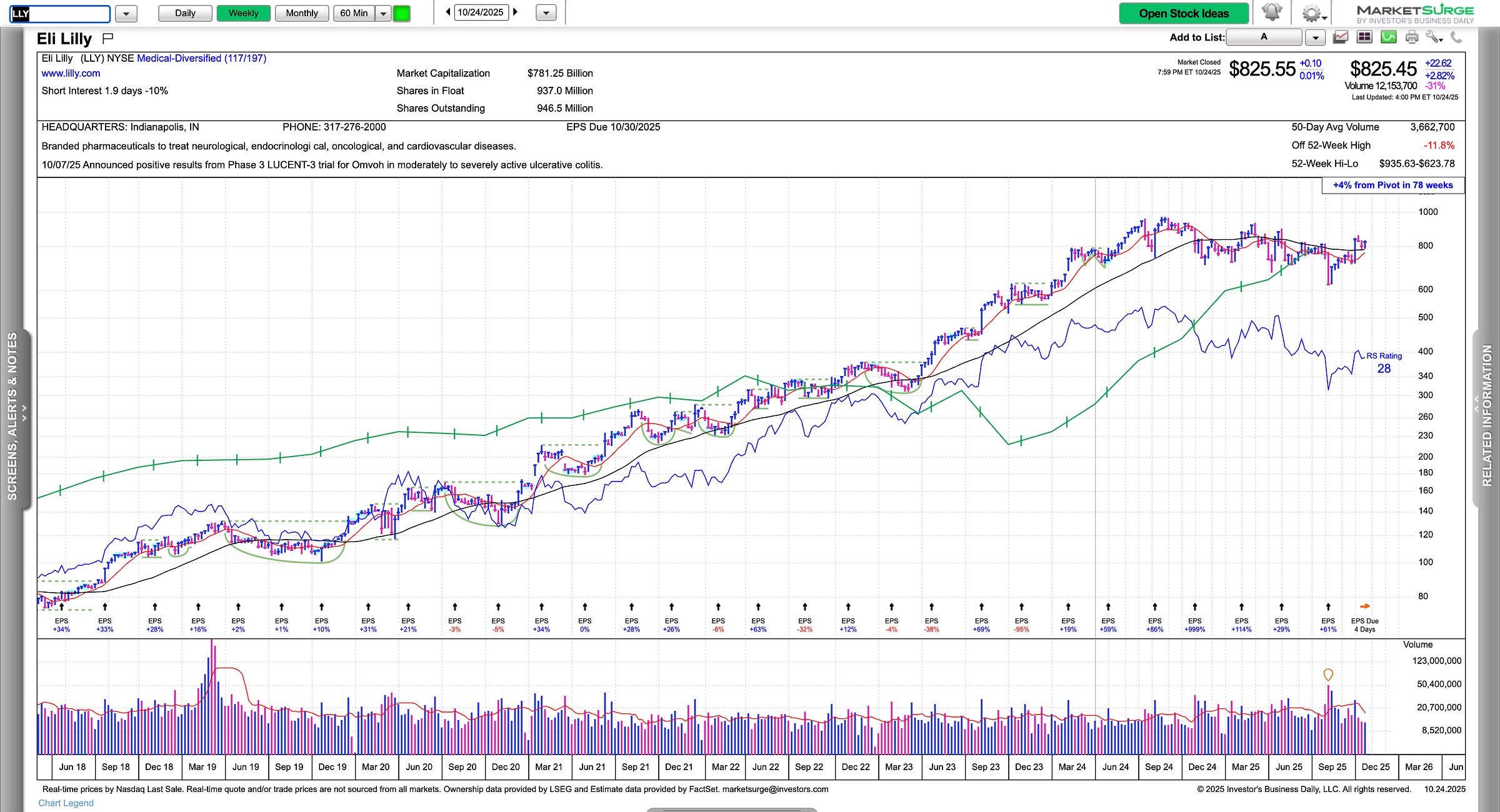

AAPL, MSFT, GOOG, AMZN, META, LLY, V, MA, XOM, CVX, CAT, BA, ABBV, UNH, MRK, HSBC, NOW, LIN, NEE.

Focus: Big Tech (AI/cloud), Healthcare (GLP-1), Financials (spend), Energy/Industrials (demand).

Market thoughts:

Market Thoughts

The NASI turned up sharply from its recent lows, signaling a potential shift in market breadth just as we head into a pivotal week packed with major economic data and earnings.

As earnings season unfolds, our indicators continue to point toward a new accumulation phase—one that aligns with both our technical and philosophical frameworks. This setup reflects a rare convergence of timing, confirmation, and catalysts—conditions that have historically preceded the next major leg higher in market cycles.

We maintain that an NVDA $10 trillion market cap will likely define the eventual “top” of this AI-driven cycle, or at least a significant pause. Its recent move toward $5 trillion marks a historic midpoint—both a psychological milestone and a springboard for what could be the next, more powerful phase of the AI expansion.

Positioning now matters most. The coming weeks, especially ahead of key AI earnings, may offer one of the last opportunities to build meaningful exposure at favorable average costs before momentum accelerates.

Indices

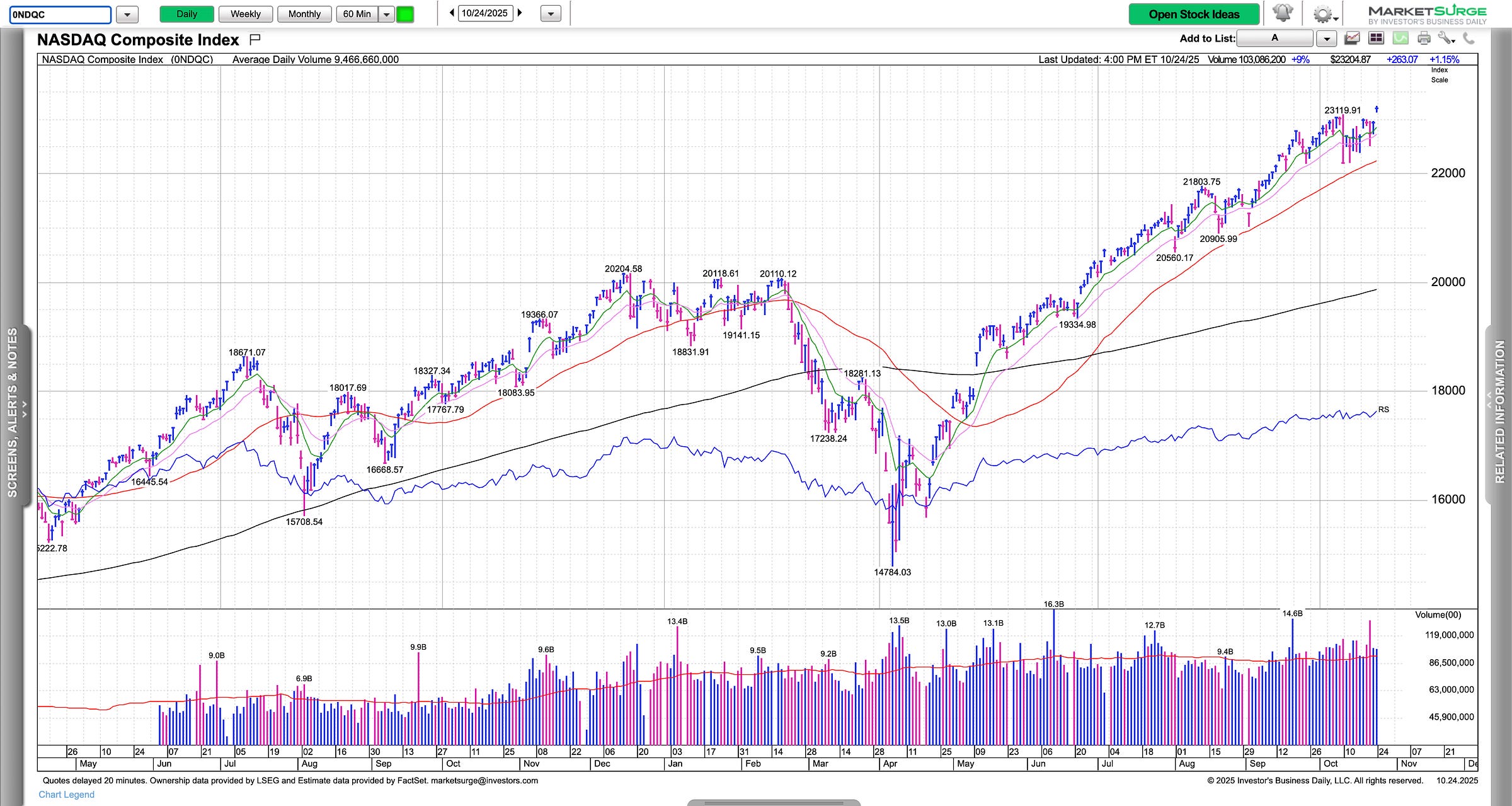

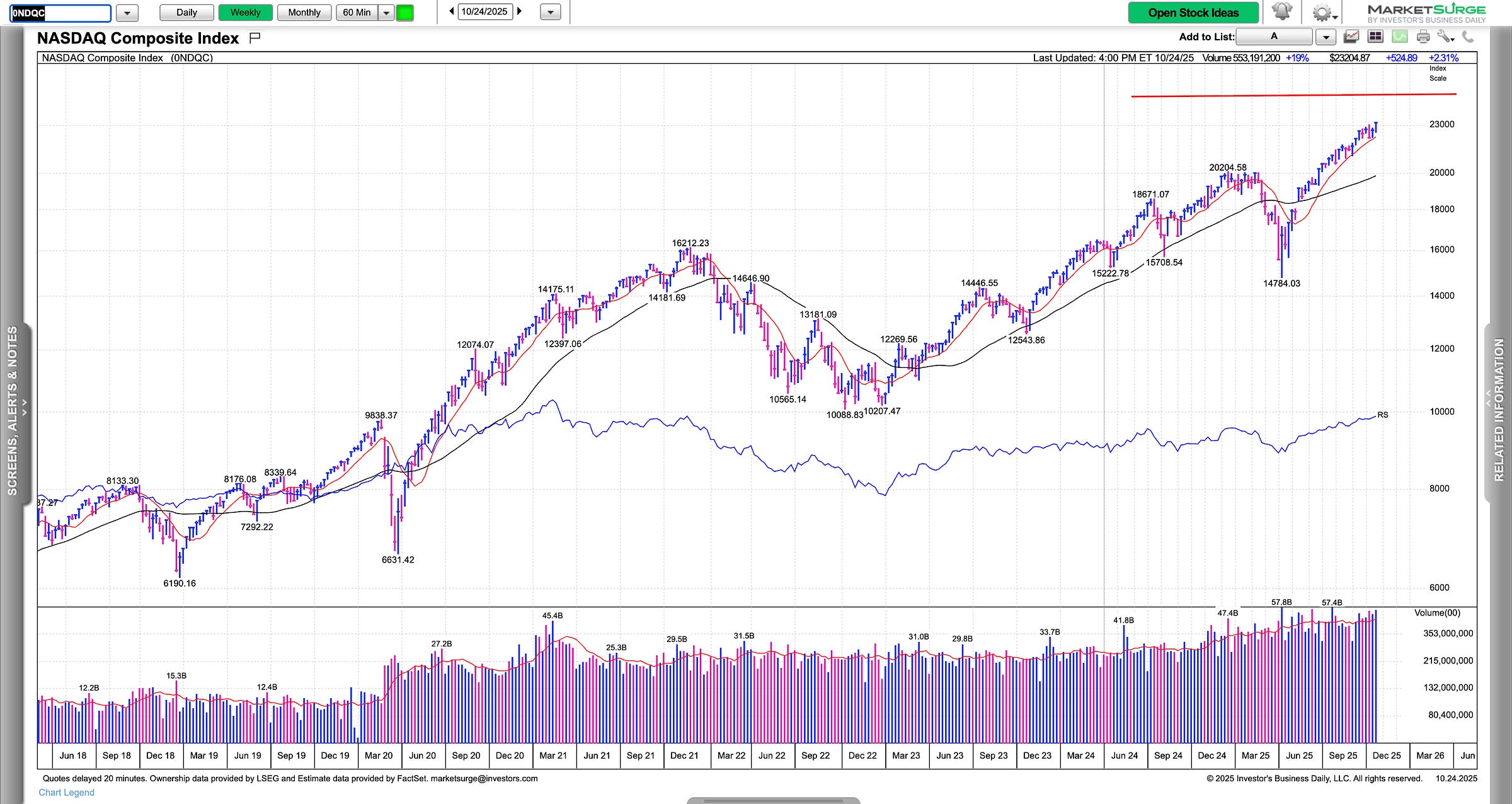

Despite all the noise, the major indices closed at new all-time highs this Friday. Back in April, we highlighted the potential for a lockout rally—similar to 1998, when the Nasdaq broke through the 2,000 level and ran to 2,500 before consolidating. Today’s market is showing a similar rhythm: the Nasdaq has cleared the 20,000 mark and now sits roughly 10% away from 25,000.

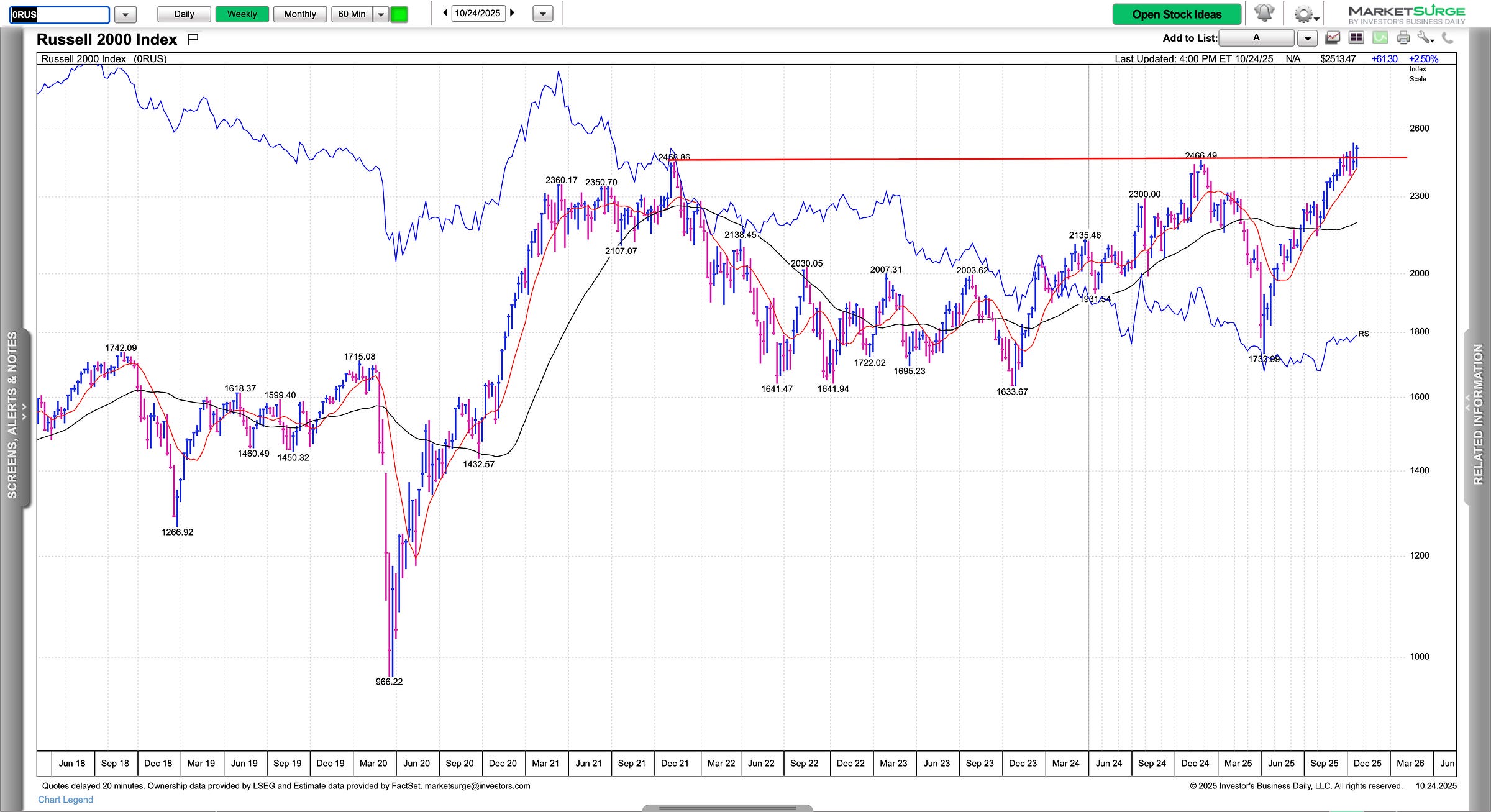

It may not play out exactly the same, but history often rhymes—and so far, the pattern holds. Meanwhile, the Russell 2000 is finally breaking out of a four-year base, a constructive sign for broader market health and risk appetite.

Nasdaq composite continues as a lockout rally, has yet to even break the 50 day.

Weekly view if it were to mimic the 1998 move, it would push toward $25,000 with little drawdown, so far thats seemingly the case.

The Russell 2000 breaking out after a long 4 year base. Interest rate related or not, it gives a lot more breadth to the market.

Institutional Stocks:

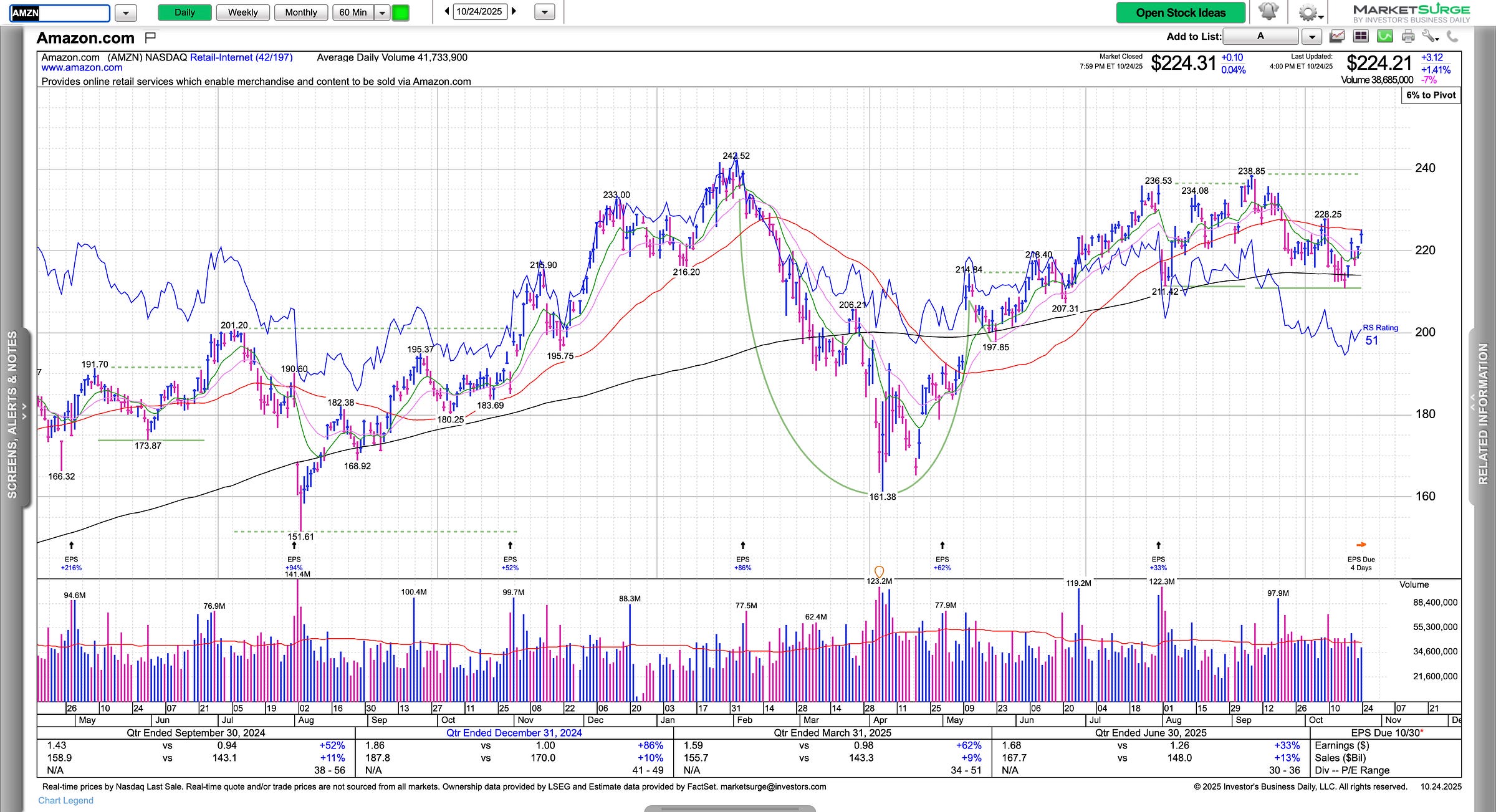

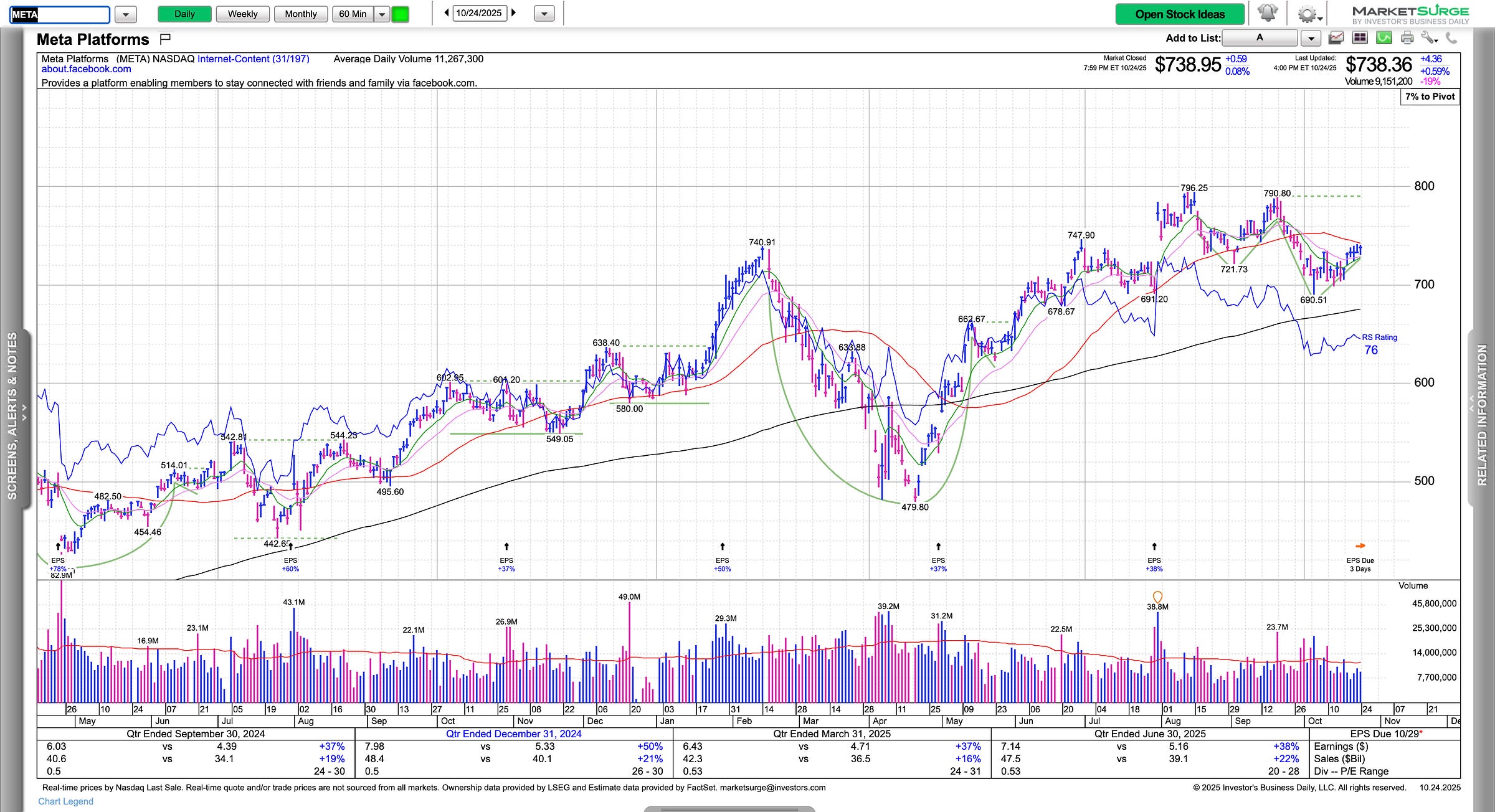

All the below stocks report earnings this week, all have printed an all time high or are within striking distance of breaking out to all time highs, possible see some names like AMZN play catch up.

AAPL breakout, little shakeout but had some continuation, looks like it wants continuation higher.

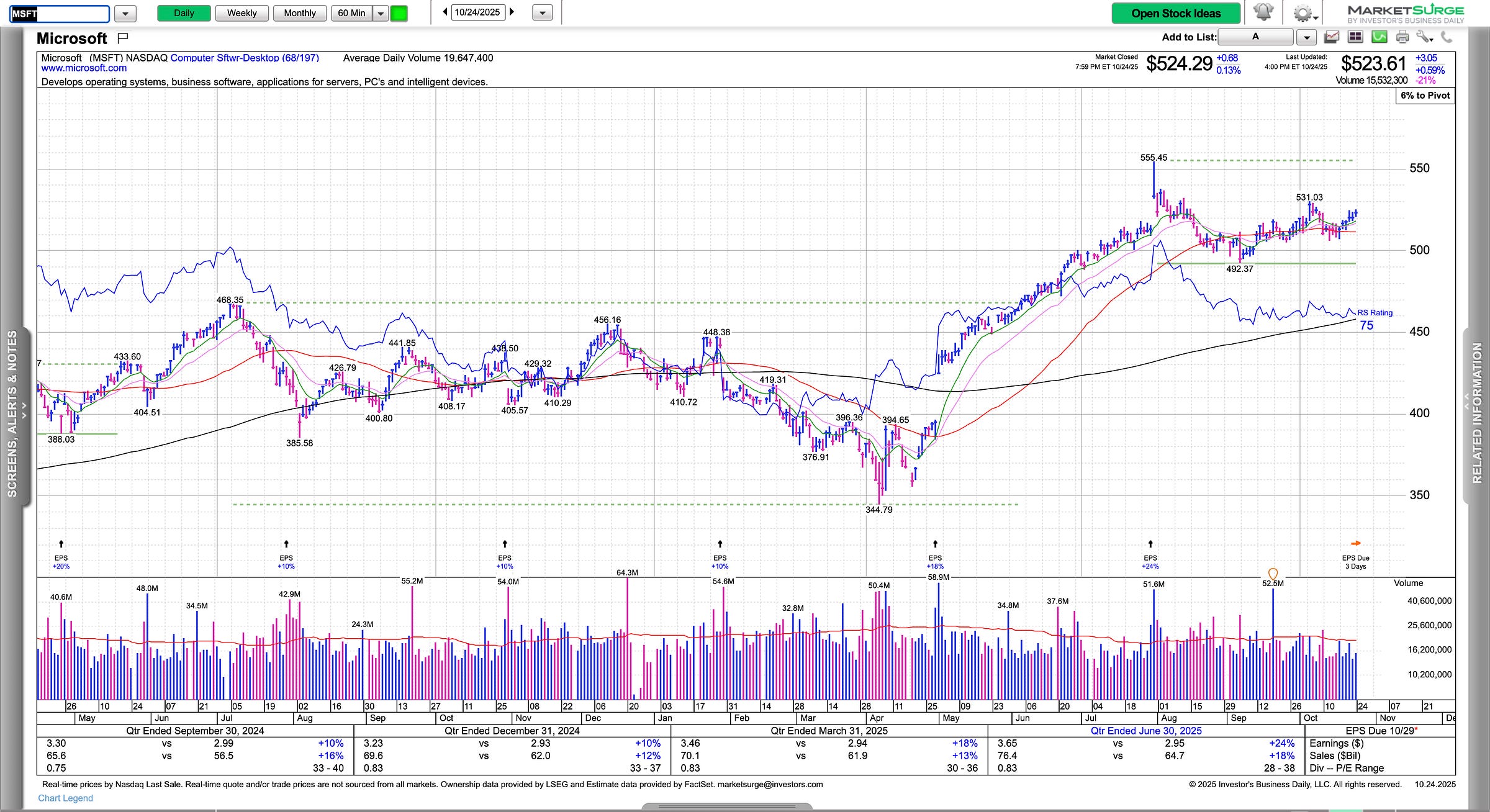

MSFT which we discussed the stability at the $500 level, has a meaningful high volume close, sandwiched between the $500 level and the HVC.

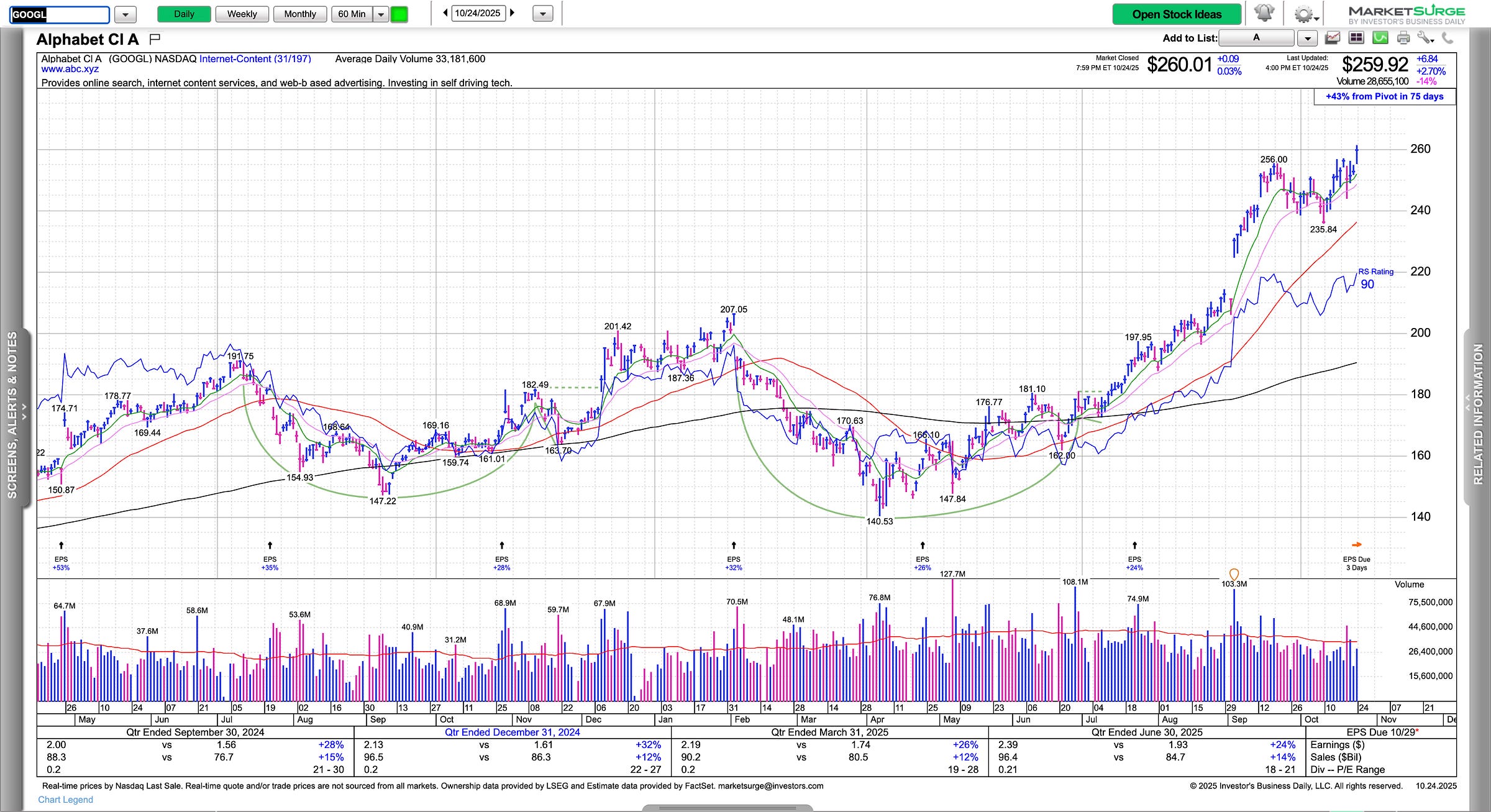

GOOGL continues higher after a brief pause at 3 trillion market cap.

AMZN has been sloppy to say the least, ideally plays catch up through an earnings move.

META similar to AMZN, sloppy price action recently.

LLY has been basing here and thinking it may be ready for the $1000 level attempt and 1 trillion market cap.

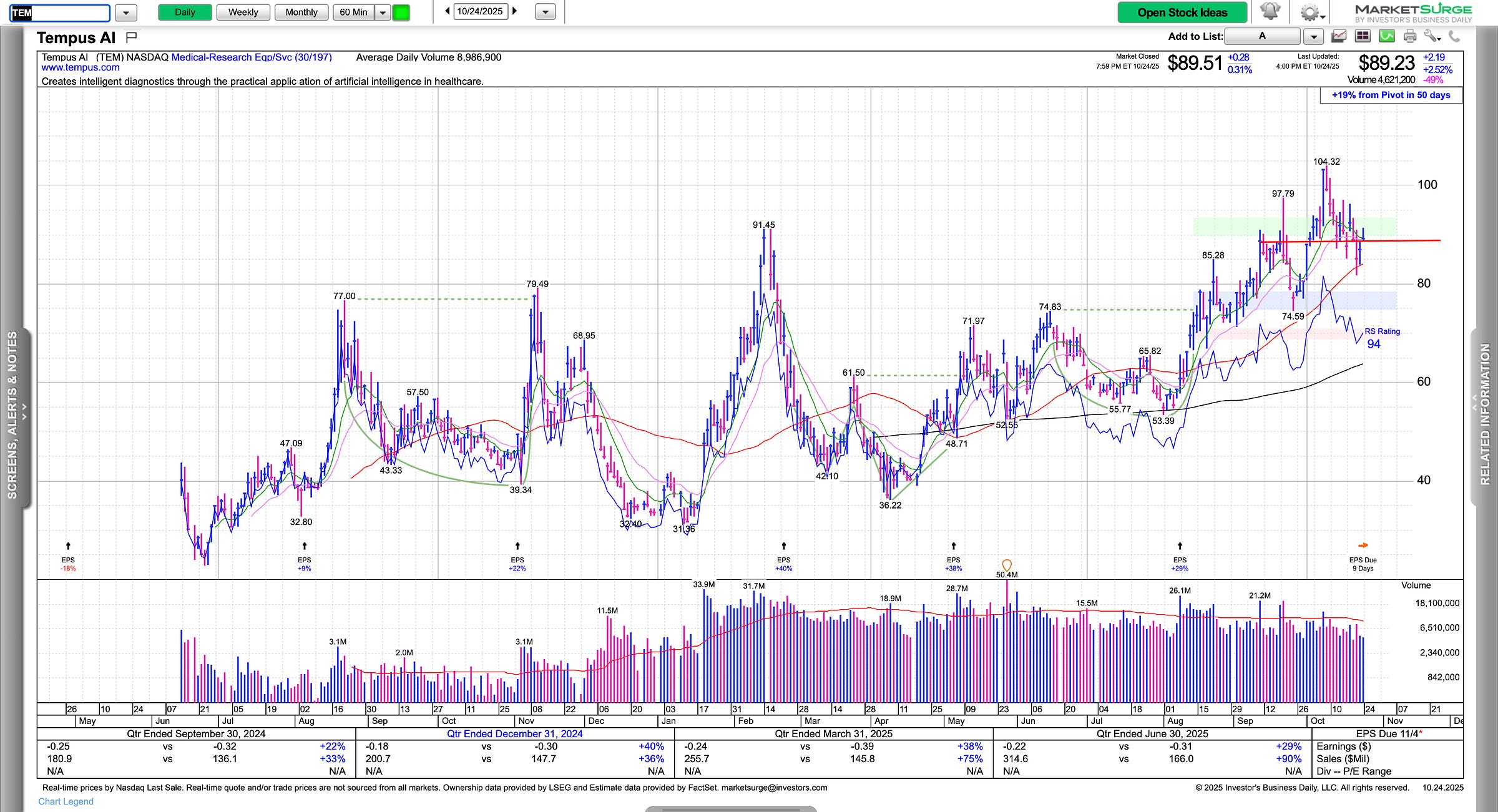

Growth Stocks

We focused on a handful of liquid leaders for the AI theme, AMD, NVDA, TSLA, PLTR. So far these are pushing higher, the big question for continuation in this cohort in general I believe will be NVDA and it’s action around the 5 trillion market cap.

AMD strong continuation.

TSLA formed a pivot here around $440-450 level.

PLTR pushed out of range, threatening a breakout.

NVDA recovered the $185 breakout level but the big question is NVDA 5 trillion market cap.

ALAB basing, starting to recover some pivots, eyes on the right side of a base forming.

TEM, milling around this high volume close, think there is a lot of potential here but the price action is still chaotic and immature.

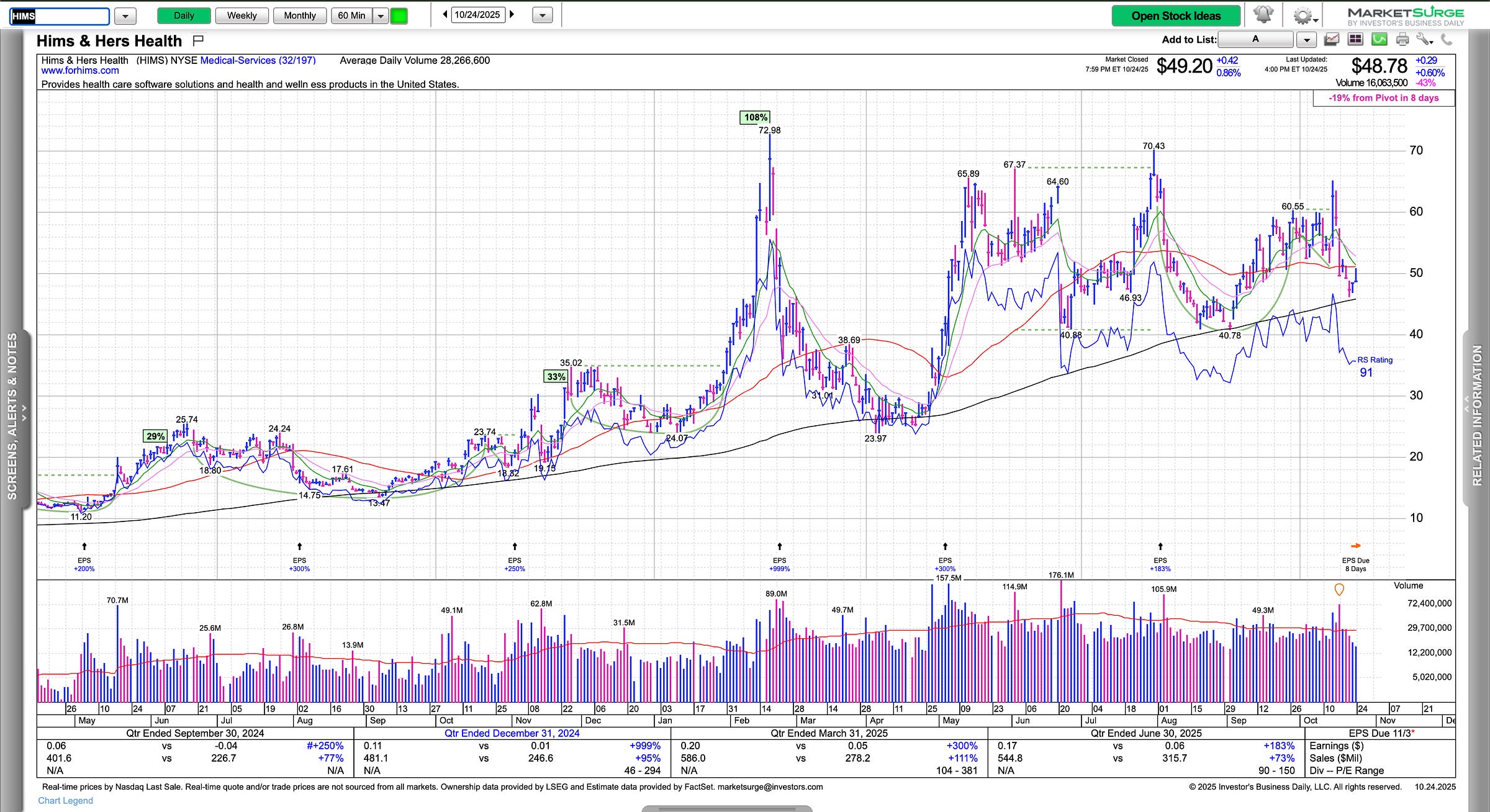

HIMS similar to TEM, chaotic and immature, however at this $50 level is decent risk reward.

SOFI digested it’s recent gains well, pushing out last week to threaten a breakout.

CRDO pushed out, possibly done basing.

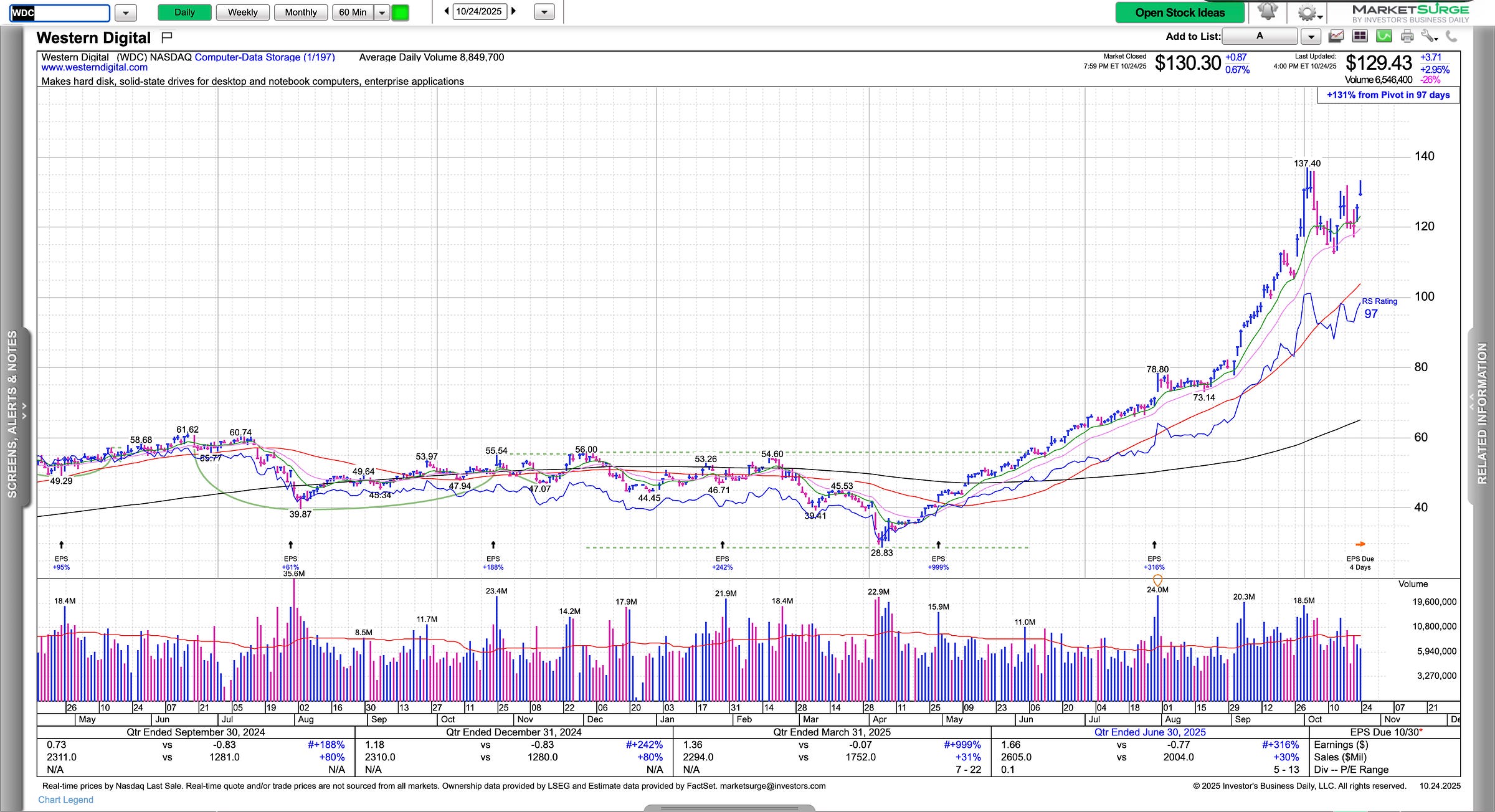

WDC pushed out, possibly looking to gain traction higher from here.