🎢 Overarching Themes

Uptrend

Small caps > large caps for the next leg higher

S&P500 x $5,000

🗓 Weekly Themes

Crazy party analogy

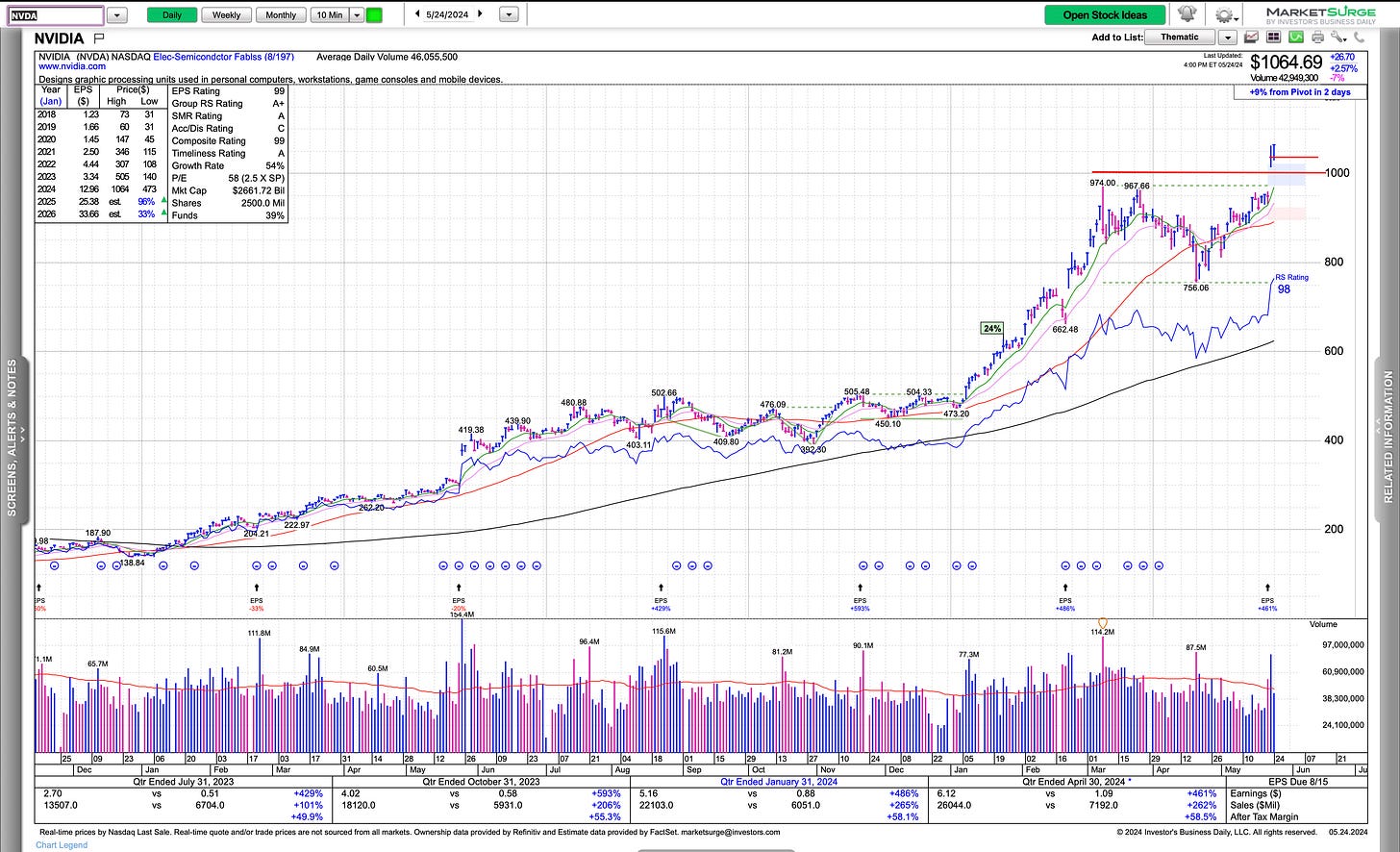

NVDA HVC

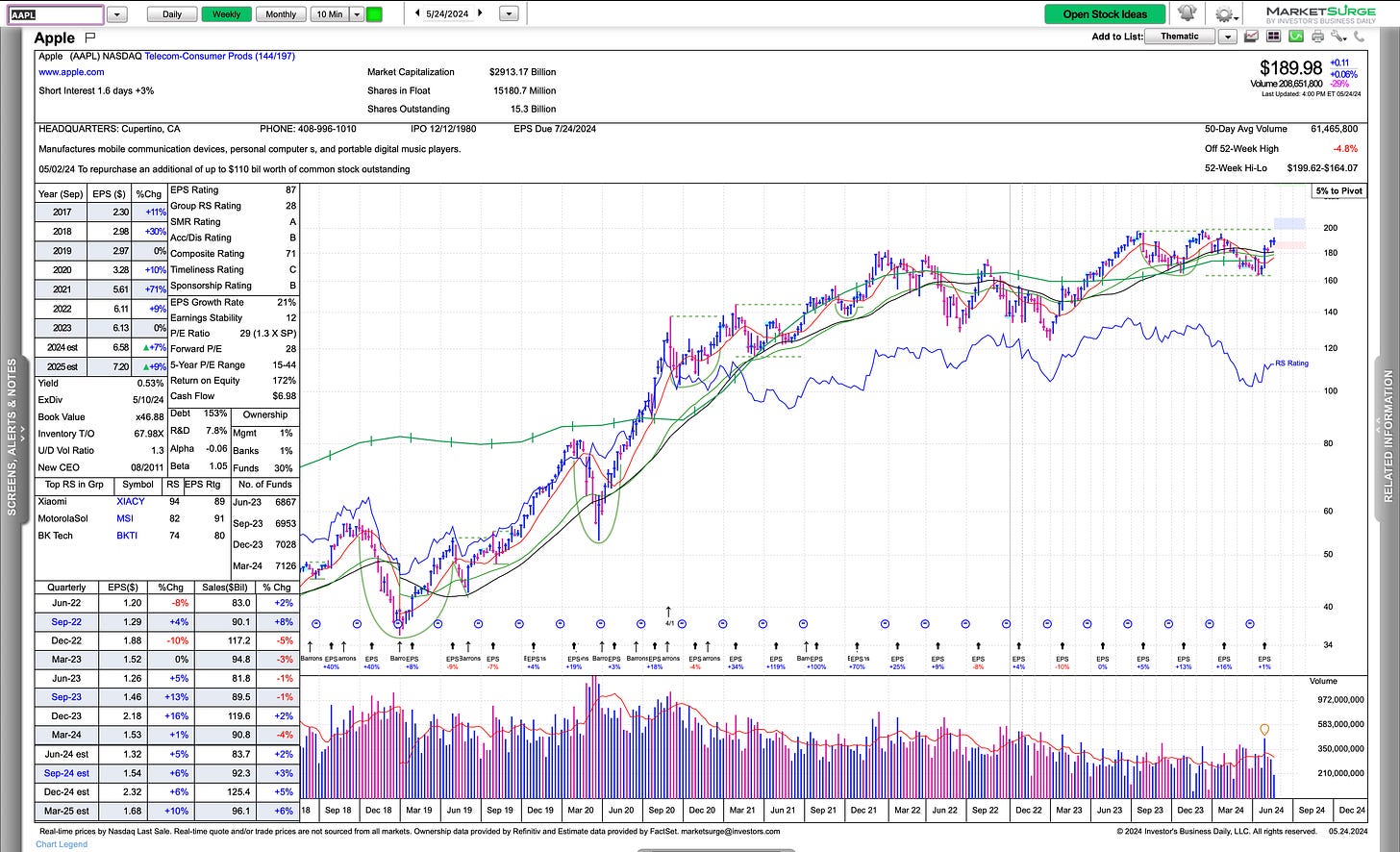

AAPL HVC/3T

Looking for the overarching theme of small caps> large caps

Thoughts:

My thoughts last week summarized were that lows of bases may be forming while anticipating the right sides of bases beginning. Until some major levels in the indices and leading stocks are taken out to the downside, we should lean bullish. We got a slew of additional clues this week, and I want to use an analogy of a crazy party. Imagine there is a typical party going on. All of a sudden, someone does something crazy—let's say they jump from the roof into the pool. The party can then take two directions: it either turns up significantly into an insane party, or it frightens the existing partygoers, and the party dies down as folks begin to leave.

NVDA’s HVC over $1,000 and even AAPL holding its HVC and reaching $3 trillion (where the market has continuously topped) is a massive move. The reaction can only go one of two ways, and my guess is it’s going to be an extreme one. Either we see an insane AI rally where NVDA and the market take off to uncomfortable levels, or we fail here and are topping. The non-extreme example is just a sideways digestion.

Indices:

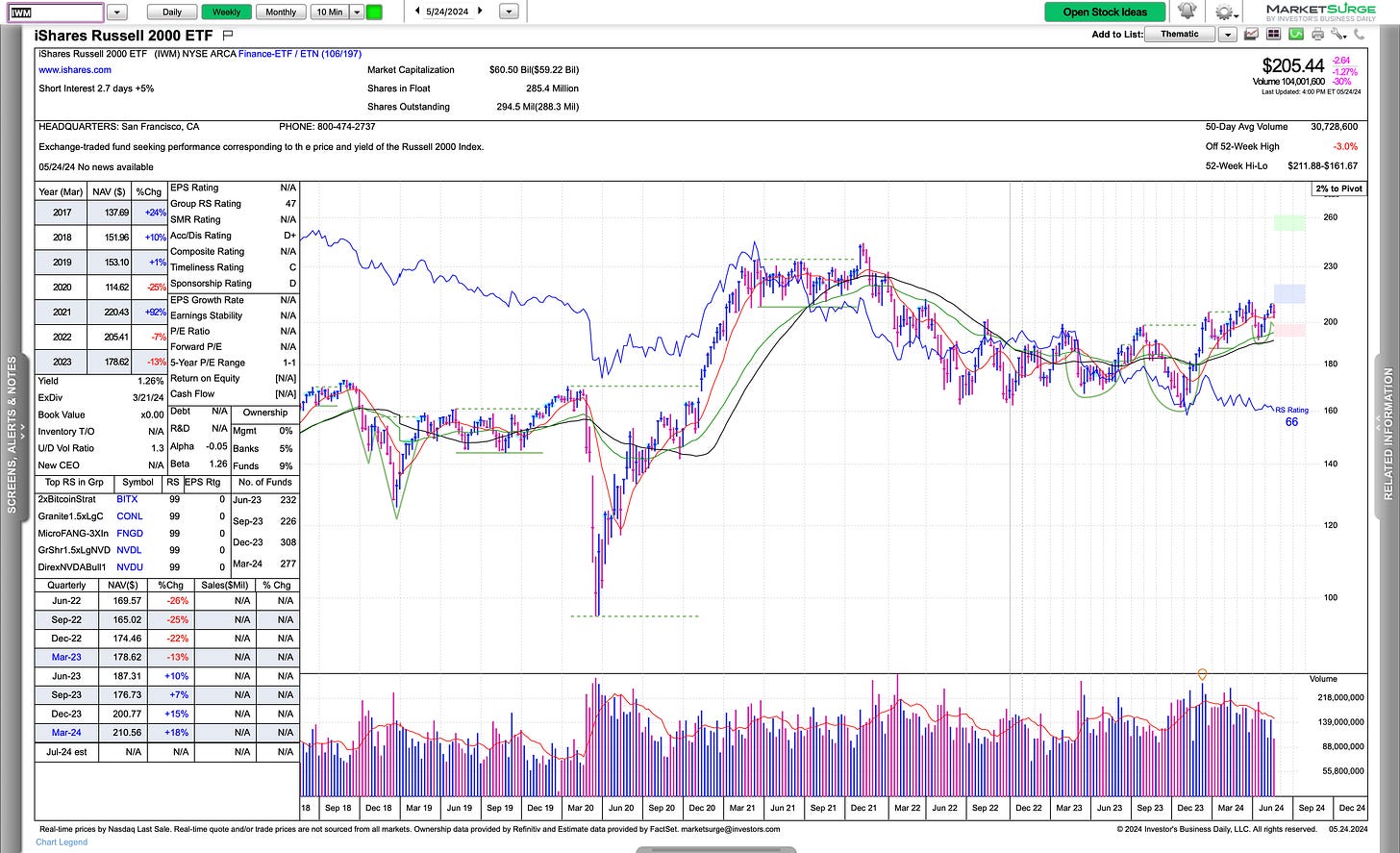

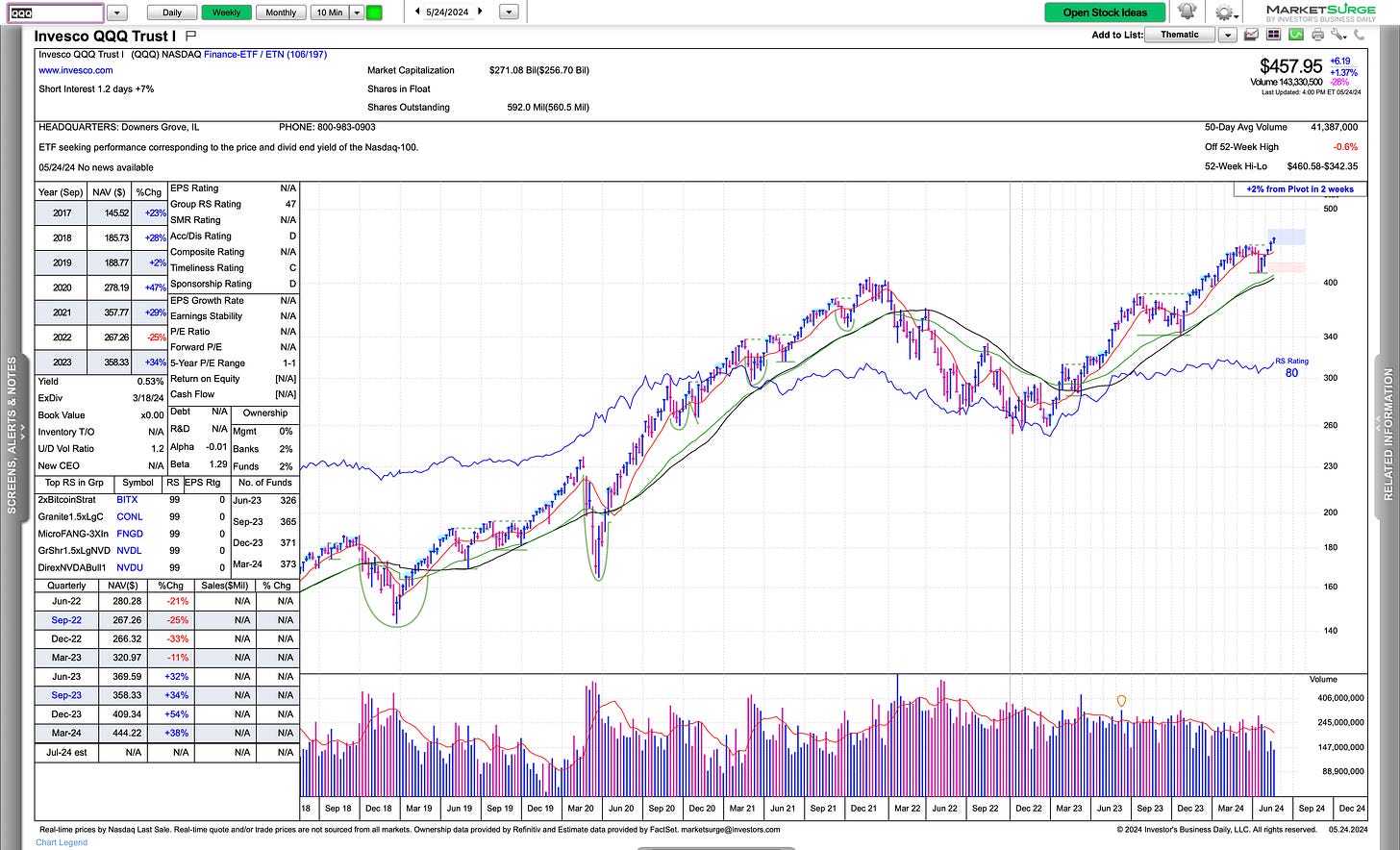

We have SPY and QQQ consolidating at highs with QQQ stronger than SPY as we want, short term support for QQQ is going to be $453. The main one I am eyeing is IWM to see if it can lead us here.

If IWM can form a weekly higher low here, this would begin to look really good for a breakout as this name has lagged the other indices for the last few years.

Institutional Stocks:

The leading institutional stocks are either trading at highs or looking like they want to go much higher… AMZN still feels like the best risk/reward for a breakout here.

AAPL is back at just under 3 trillion after holding its earnings HVC, this stock won’t go away which in general market terms is bullish.

AMZN ran to all-time highs and then has squatted at the breakout level which is still rather constructive, looking for it to turn the corner here and head breakout in a lockout rally for the name.

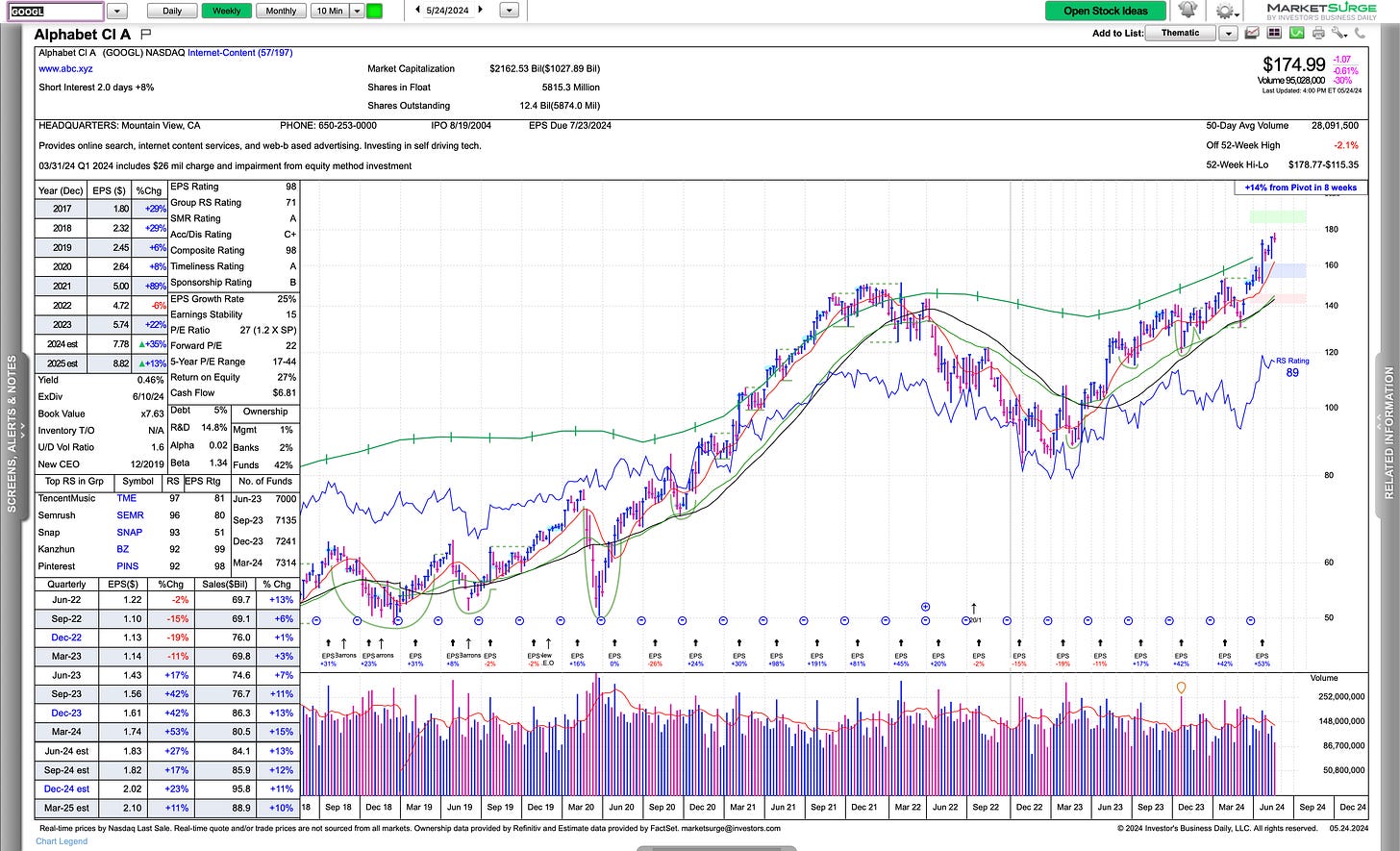

Sharing GOOGL just to show it’s clearly trading at highs…

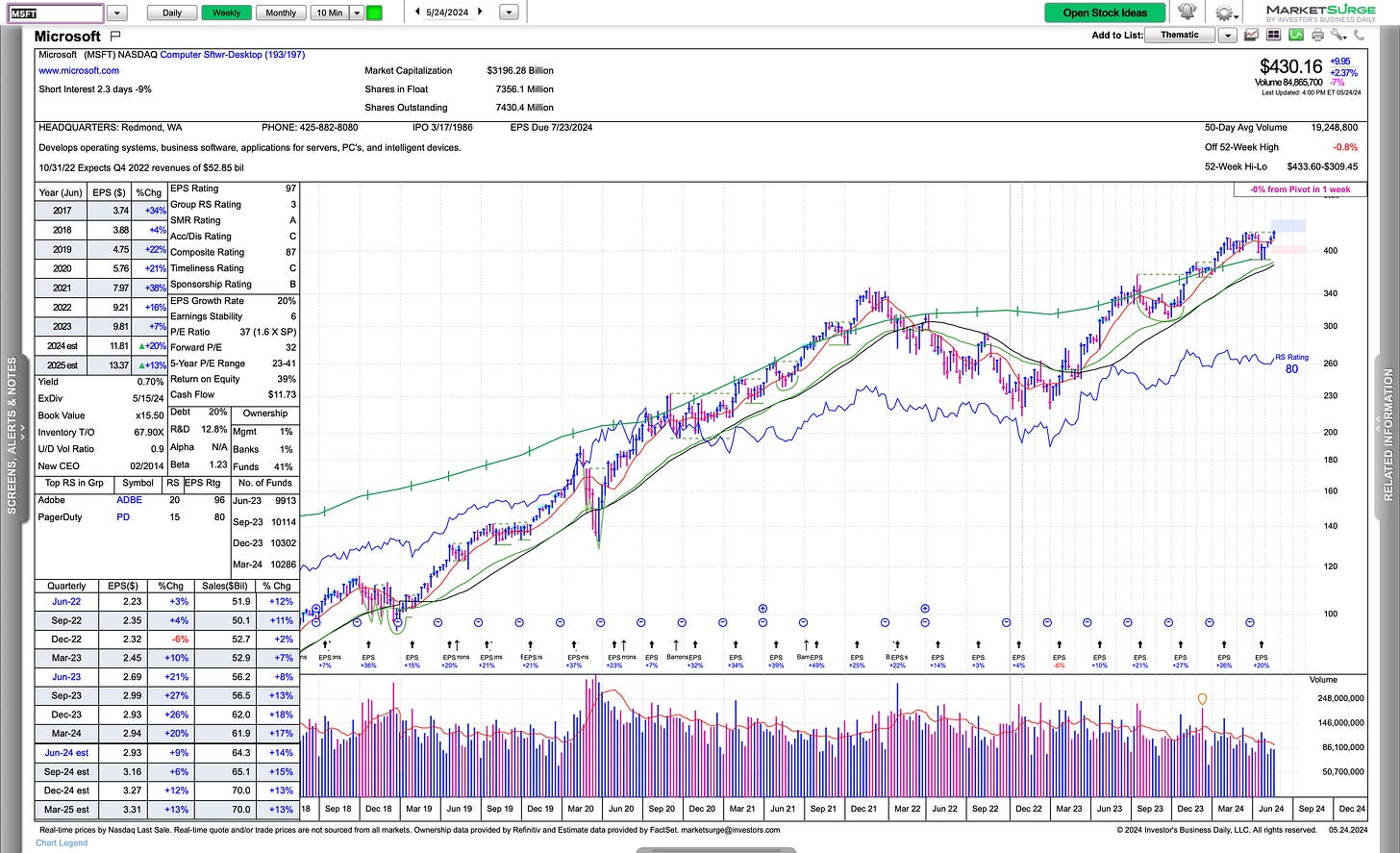

MSFT the largest name and back to trading at all time highs and threatening all time high territory.

If these stocks maintain these levels and push the hurdles,

Growth Stocks:

As I shared with my thoughts, if NVDA is going to hold it’s HVC and the $1,000 level, we may be in for an uncomfortable run to the upside. If that fails, with no clues of right sides of bases in other names, huge red flag.

TSLA possibly looking to turn he corner as it consolidates at the 50 day here.

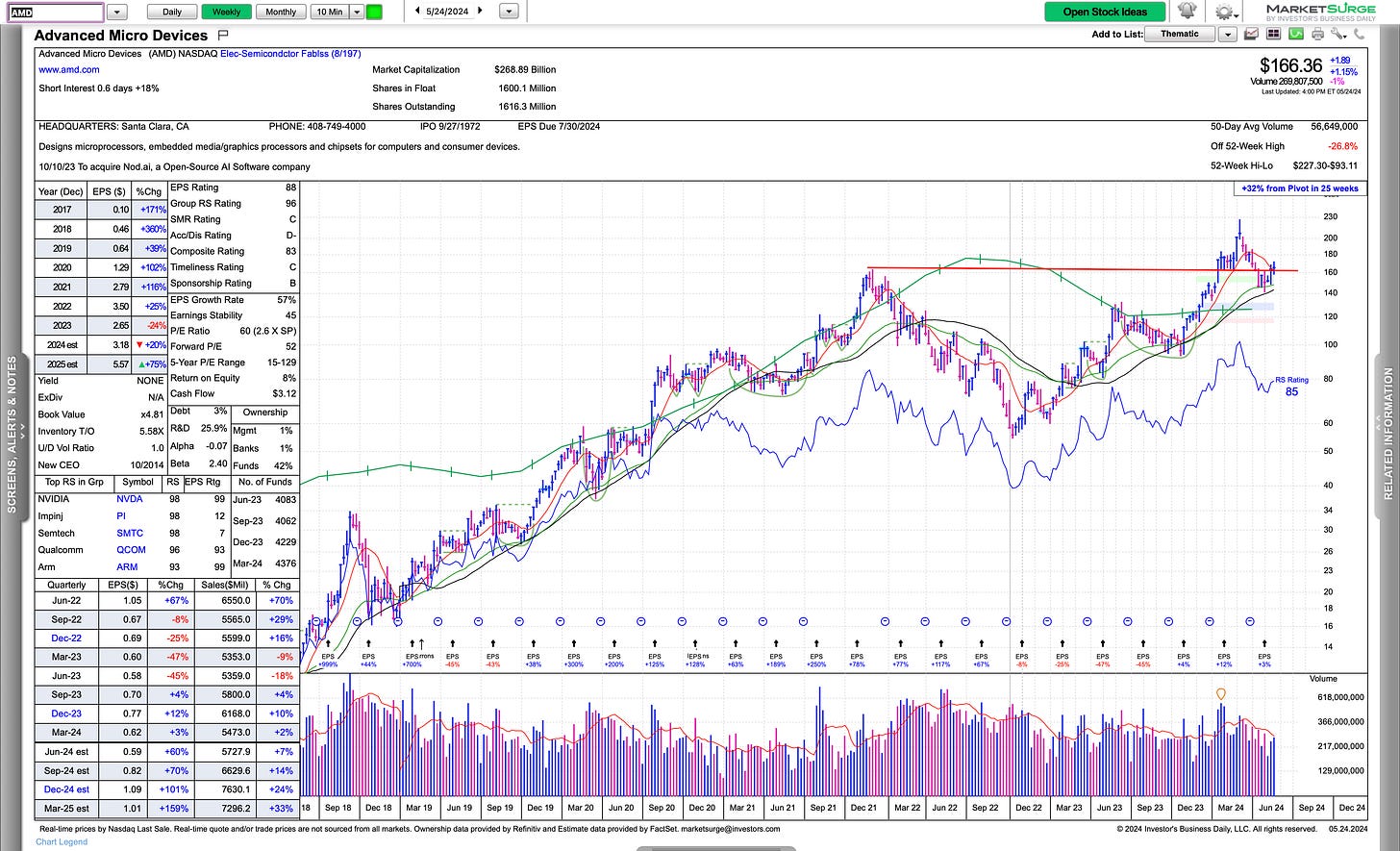

AMD is a top setup here with a revisit of the previous breakout level and holding, may need to consolidate here, however, it looks like it’s going to form the right side of a base, and if that occurs, you have a base on another base, which is quite bullish in the top sector.

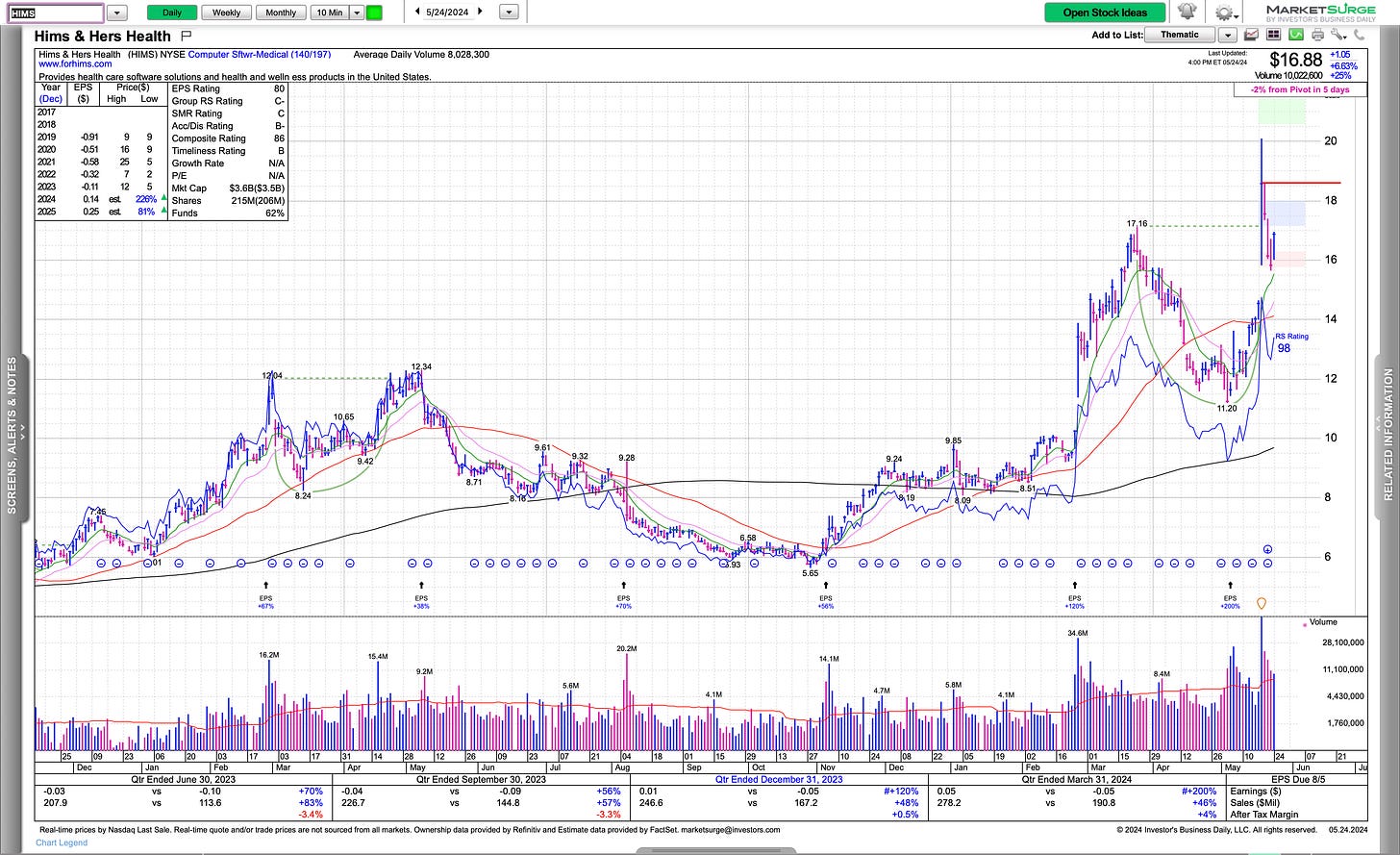

Touched on HIMS last week and it still looks great, had a massive move and then gave it up to sit at the breakout level, above it’s HVC which may take sometime, it looks primed for more.

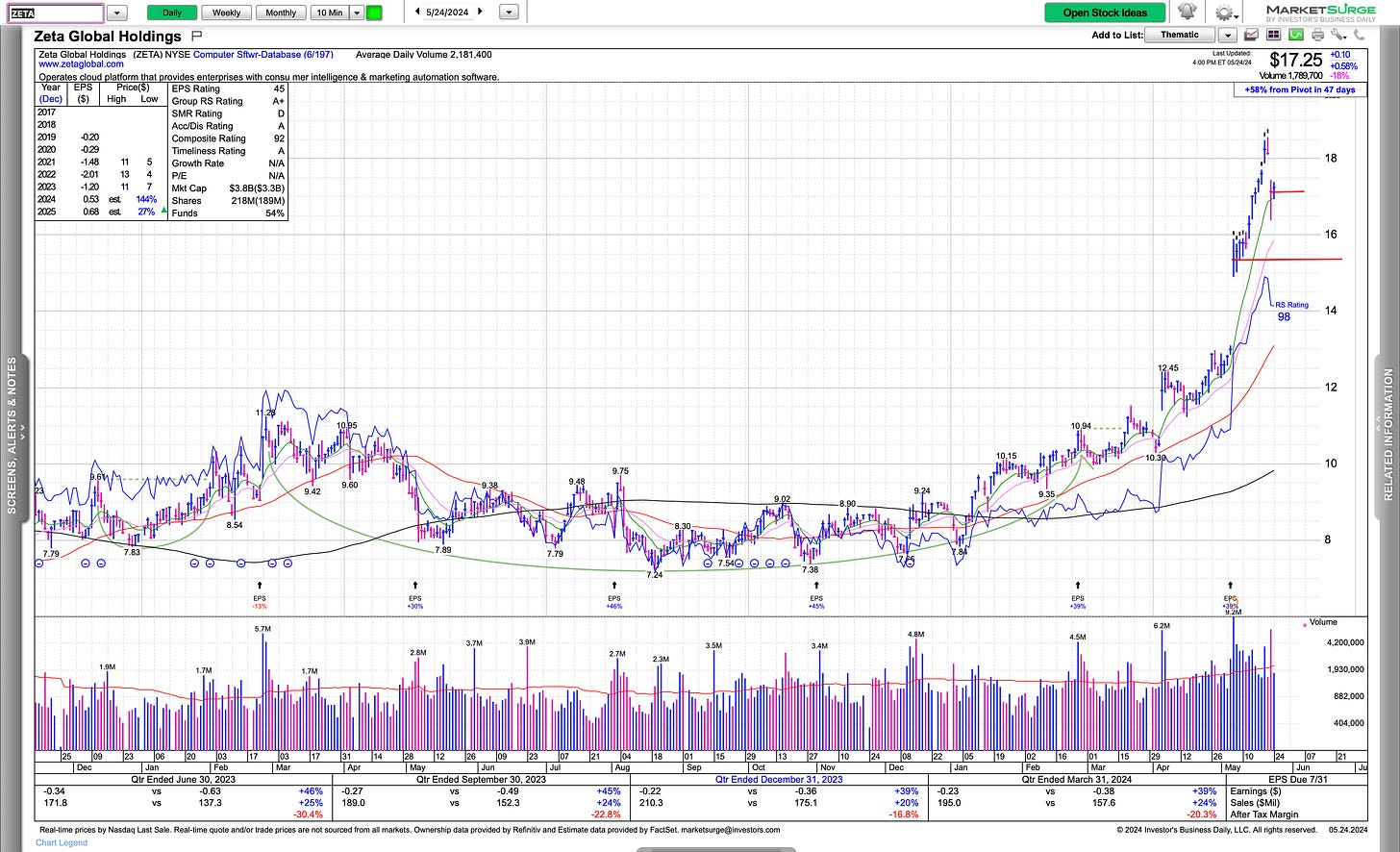

ZETA had a pullback and so far its showing signs of character change, still looking like it’s building some maturity and preparing for another run.

MU still hanging in here, consolidating in a debatably volatile action lately and last week, however, it’s sitting at the breakout level and strong as can be, no reason to do anything here but hold, or if you have no exposure to try and get a piece of this one before it’s gone.

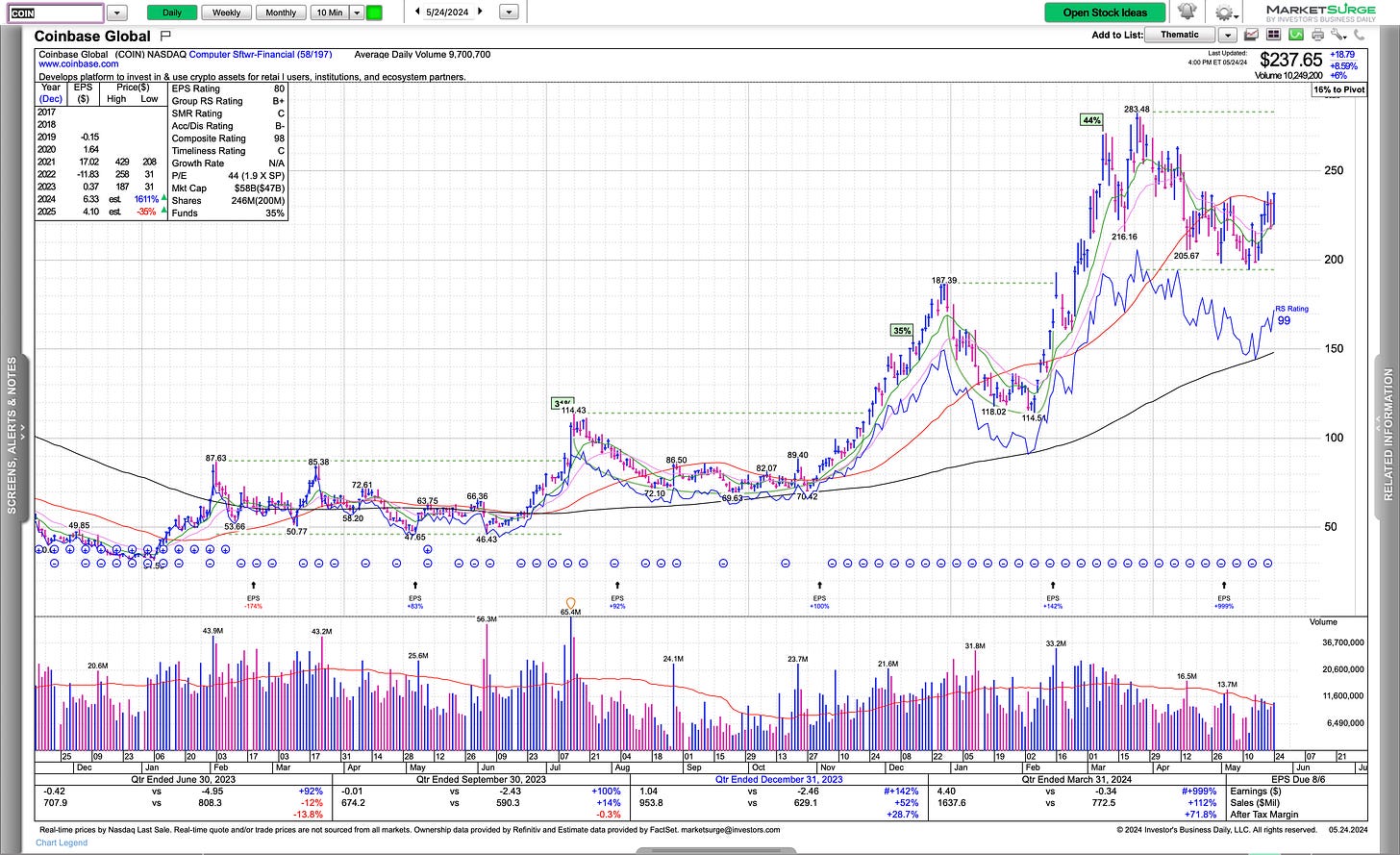

COIN which has been interesting as it consolidated at the 50 billion market cap was getting interesting and starting to get frustrating as there was wide price action and little traction on a week to week basis however it’s firmed up and back above the 50 day.

HOOD showing signs of being a winner however it is likely going to take some time to develop maturity in its price action.

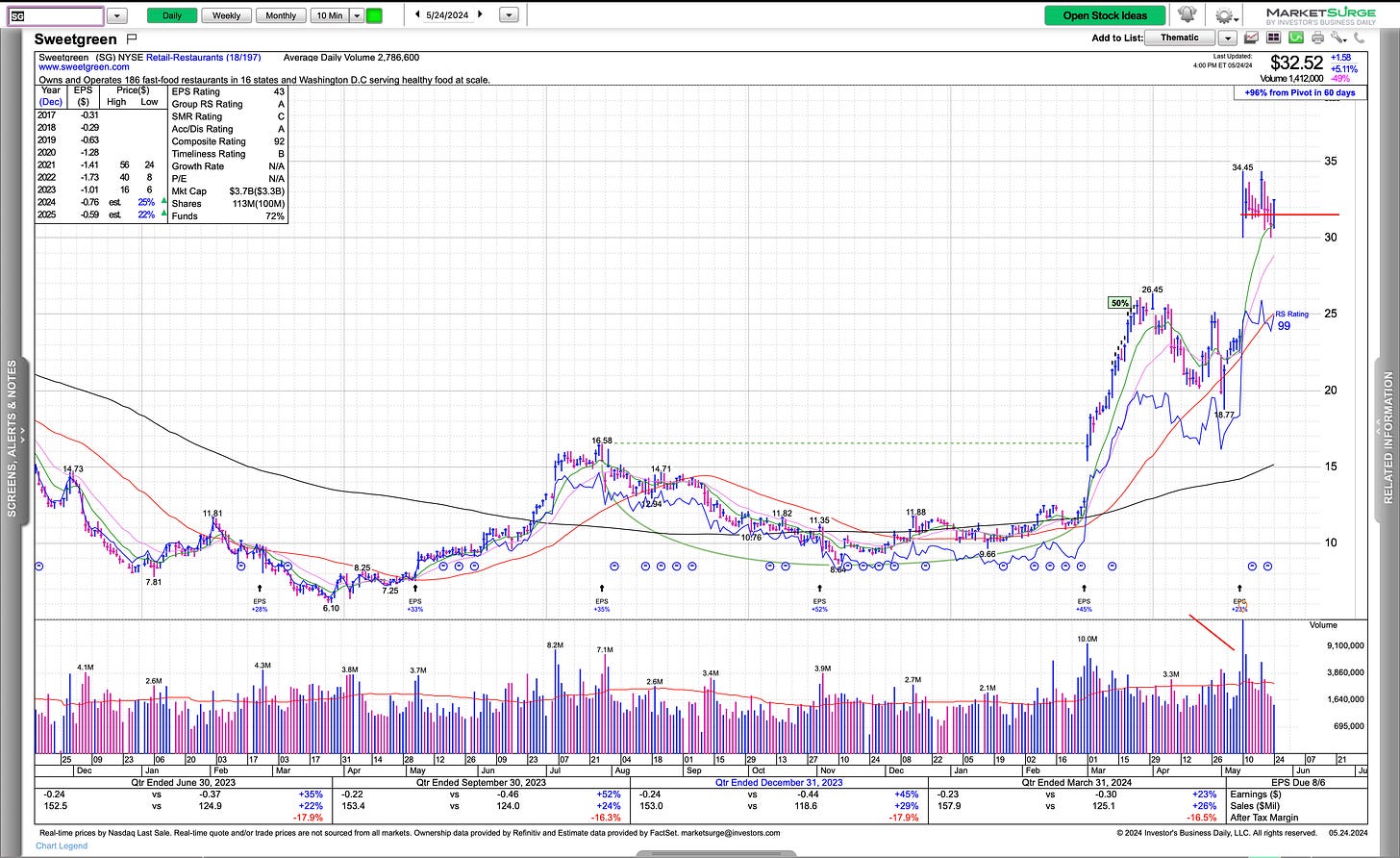

SG is a new IPO that had massive volume and consolidating, this one can go and is a low risk entry here.

Lastly, I am eyeing some beat down names like UBER, SHOP, and DASH just more wait and see at this time.